| Back to Back Issues Page |

|

|

Should you be afraid of growth? Dividend Investors' Detox, Sept18 September 13, 2018 |

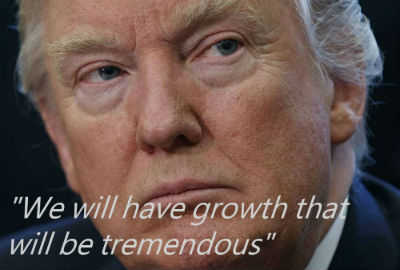

Dear Dividend Investor,Do you need high economic growth for good stock market returns?

Does this mean you should plough your hard earned savings into these geographies? I believe it isn't that simple and you should be cautious - a country's or sector's high level of growth may actually cause your returns to disappoint you. Here's why... The correlation between economic growth and stock market returns is actually very poor, and there is evidence which shows that company stock returns often work in the opposite direction to the trend of economic growth figures. For example, as Jeremy Siegel's points out in "Stocks for the Long Run" the performance of South African stocks has been fantastic for over a century with real annualised USD returns of over 6% per year from 1900-2012 (better than the US), yet the South African economy has performed poorly over during that period with real per capita GDP growth of around 1.1% (compared to around 1.7% and 1.8% for Australia and the US respectively). The inverse of this is also very obvious. China is the most best example of this. From 1988-2012, the real per capita GDP growth was an astonishing 9.5%. Common sense suggests that that would be great for stocks - but no, investing in China has been horrific with annualised returns worse than -5% in that time period. In fact, in the normal cycle of things, dividend investors are among the happiest people when recession hits. Just watch this Australian Dividend investing guru declare he wishes for another Global Financial Crisis (GFC), here Other articles you might like:

Here's why the correlation between economic growth and stock market returns is weakFirstly, in a booming economy there tends to be excess capital in the financial system. This can result in companies making very poor capital allocation decisions and suffering huge competition, both of which are very bad for business.The second reason is that in a strong economy investors tend to bid up stock prices on the assumption that returns will be strong forever and if you invest at these over-inflated prices, high levels of returns are that much more difficult to achieve. These phenomena are not just restricted to countries. It is the same with sectors. Historical data show that many fast growth sectors have turned out to be terrible investments. Just look at radio stocks in the 1920s, airlines through most of the 20th century, and, of course, internet stocks in the late 1990s. At the opposite end of the spectrum - do you know the best performing stock in the S&P 500 between 1957-2012? The answer is the tobacco manufacturer Philip Morris. This is despite nearly half the population being smokers in the 1950s yet under 20% being smokers in 2012. Philip Morris, though, has had some huge advantages which have given it annualised returns of around 20% in that 55-year time period. They had virtually no new competition (try getting regulatory approval for a new tobacco company), a product that hasn't changed (they haven't had to invest in R&D), huge pricing power, and, due to frequent negative sentiment in the industry, often relatively low stock valuations. With these advantages, basically all the cash they've generated - and it's been a lot - has gone straight back to shareholders through either dividends or share buybacks. Obviously you may have serious misgivings about the ethics of investing in tobacco or other "sin sectors", but this example does highlight the point that low growth sectors can make good investments if the underlying business displays the right characteristics. So to summarise: Chasing growth from a top down level by looking at the broad macro picture first (i.e. in terms of fast growth sectors, countries or regions) is not your best way to produce consistent returns. Although fast growth is doubtless good for a country, it's not so good for companies. And what matters for you as a stock holder is the health of the companies whose stocks you buy. They must be generating excellent returns on the invested capital in the business, have pricing power, a solid balance sheet and their stocks must be trading at a reasonable price. This last point is crucial as even if you find a high quality company, it isn't worth an infinite price as Charlie Munger states in this BBC video. So after all that talk of returns on invested capital, does anyone fancy some Bitcoin...? (Kidding!!!) But if you're tempted to say "yes", you might like to hear Warren Buffett's opinion of cryptocurrencies before you buy... click here! Keep seeking quality!Mike Roberts |

| Back to Back Issues Page |