| Back to Back Issues Page |

|

|

Easily predict the markets! Dividend Investors' Detox, Aug18 August 12, 2018 |

Dear Dividend Investor,How to predict the markets and deal with whatever comes up!

2018 has certainly been a volatile year so far. In the first six months, the main US indexes were around flat. The S&P 500 was up around 1.7% year to date, the DOW Jones index was down 1.8%, and many other major indexes around the world were down through the end of June. The year started positively after the significant corporate tax cuts announced but the market then dropped on the back of concerns about trade wars and worries over valuations. The threat of rising interest rates in many countries around the world is likely to make the investment waters even choppier. Other articles you might like:

The market seems choppy - what should I do?This is a question I often get at RetireOnDividends.com, but my response is that I don't even attempt an answer!That doesn't sound very useful, I know, but I believe it's key to focus on the knowable and let go of what is completely unknowable. The fact is that there are many very smart Wall Street analysts, traders, researchers, academics trying to work out what the market will do next. How can you or I as individuals possibly outsmart them? The answer is that we can't and, very often, they get it wrong anyway! It is simply impossible to accurately and consistently predict what the markets will do over the next month, six months, or year. I firmly believe you're wasting your time even trying to make these predictions. Instead, I focus on what you can control and understand. If you're analyzing stocks, then seek out companies that have consistently generated lots of cash, had high returns on equity for many years (in both good times and bad), have high barriers to entry, have a history of treating owners well, and have very solid balance sheets with low debt to secure them from tough times. Then buy these companies' stocks when their prices are at least reasonable! This won't absolutely guarantee investment success because the future, by its very nature, is unpredictable and you could be caught out by a product becoming obsolete or poor management driving your company into the ground. You win some you lose some. In general, though, I feel you should let the markets do what they will while keeping your eyes solidly focussed on the task of finding good companies. Ignore the short term ups and downs of headlines (good and bad) and search for quality companies. If you're truly investing to retire on dividends, then you're in this for the long haul. The following two diagrams from Peter Thornhill's excellent book: "Motivated Money" gives you the perspective of a truly long-term investor. Instead of focussing on the short term fluctuations, Peter (probably the best prepared retiree in the world! Click here to find out why) only looks at the long term values:

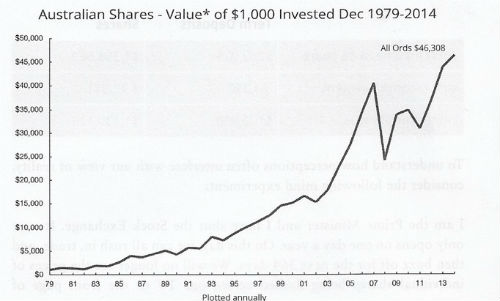

How most people see the market:

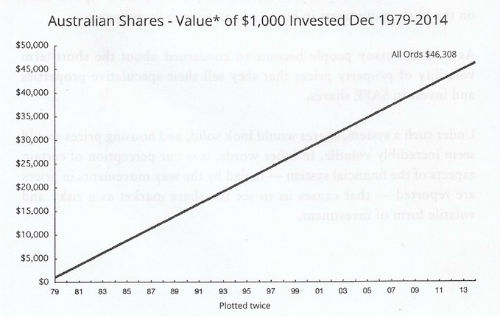

How a long-term investor sees the market: In reality, there are only two days when you need to know the value of your assets: the day you buy them and the day you sell them. What's more important is the long term likelihood of the company growing and their willingness to pay a reasonable dividend back to investors.

In reality, there are only two days when you need to know the value of your assets: the day you buy them and the day you sell them. What's more important is the long term likelihood of the company growing and their willingness to pay a reasonable dividend back to investors.

In addition to looking for companies like this, you should protect yourself from the ups and downs of the market by purchasing a diverse range of assets with solid dividend growth and dividend pay out characteristics. This will allow you to make up for any unforeseen problems. Of course you can never be sure of success, but focusing on these attributes does at least put the odds of investment success more in your favor. I do know that in the future the market will be volatile. The S&P 500 has historically been down about one in every four years and it is reasonable to expect it to do something similar in the future. There will be times when the market drops heavily and this will not always be predictable. Controlling your temperament and emotions during these times will be challenging but to do well you will need to keep a consistent approach and a steady temperament. Let the experts try to predict the markets. Let them try to work out when the next recession is, the next interest rate movement is, or whether the market will go up or down. You should be aware that markets will continue to go up and down in the future but you should always be open to opportunities and always looking for intelligent things to do with your capital. Over a long period of time, this should lead to a decent result. I close this month with a quote from the great John Pierpont Morgan who, when asked what the market was going to do one morning, answered with the words "I believe the market will fluctuate." I boldly(!) predict the same.

Keep seeking quality!Mike Roberts |

| Back to Back Issues Page |