Dividends reinvested & value up 26% ... My first 6 months in stocks!

Portfolio up 26% in value and I've already got my dividends reinvested... I'm absolutely made up with my first stock picks, and all this in spite of a flash crash that saw international markets drop like a stone in early February 2018.

When I placed my first purchase orders in July 2017, I really had no idea what to expect of my first few months of stock ownership. In my previous post, I set out some ground rules about how I was going to invest, and they seem to be working!

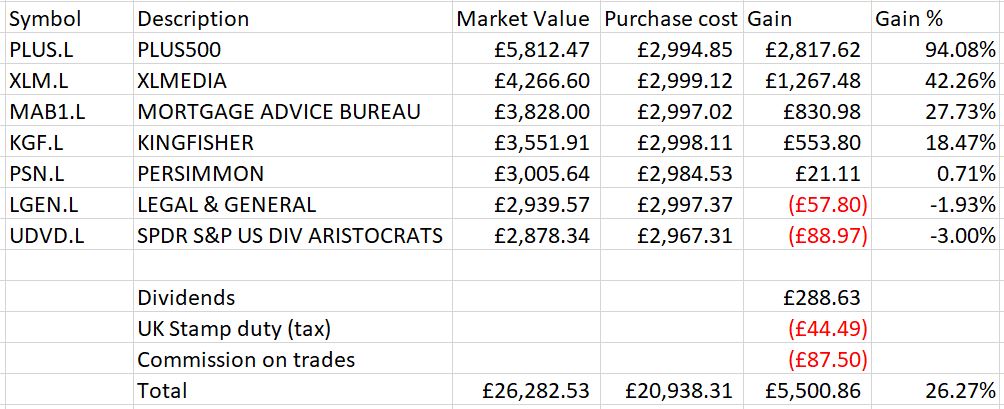

As I'm a UK resident and using a tax-free ISA account (similar to a Roth IRA), I wasn't able to invest outside the UK. Here are the companies I picked, each for a £3,000 ($4,200) investment:

My perspective is long-term. I'm looking to live off the dividends I generate starting in 15 years' time hopefully, with all dividends reinvested along the way, so I'm looking for both growth and dividend income, with a fair degree of security from bankruptcy.

Low-touch approach:

One of my main goals, having interviewed Australian dividend investing guru Peter Thornhill was not to let investing dominate my life, and as things happened, this was easier than it seemed. My day job and family life got really busy and with all that on my plate, I didn't even have time to look at new investments for one hour every other month as I'd planned.

In fact it was only during a game of golf with my buddy and co-owner of this site, Mike Roberts that I found out that one of my stocks had posted some insane results. When I finally got round to logging into my brokerage account, I found out it was up an amazing 75%.

The company with those stellar results was Plus500 an online day-trading company, which it appears caught the wave of the Bitcoin trading frenzy and announced insane sales growth and profits in the last quarter of 2017 and first quarter of 2018. The result has been an increase from £6 per share to over £11.50 since I bought them.

XLM Media has been my other stand-out performer rising 42% in the last 6 months.

Those initial purchases look like this as of today:

Of course, I have some losers. They were:

- Legal and General -1.93% (but delivering a 6% dividend this year - I'll have the dividends reinvested elsewhere!)

- SPDR S&P US Dividend Aristocrat ETF -3.60% (ironically the only pick I took entirely on my own advice!)

... but 2 losers out of 7 is pretty good, and the upsides are far bigger than the losses so in all it's pretty cool stuff!

Stockopedia - my guiding light!

I have to give credit for my stock choices to Stockopedia (click here for full review). Before signing up for their service, I had an idea of some big name stocks I wanted to invest in, but within literally a few minutes of research on their site, I could see these weren't the right stocks to buy at that particular time (mainly because they're overpriced). Of the 8 stocks I settled on in my first purchase, only one was remotely similar to the type of stocks I originally envisaged buying, and I can see the benefit of that very quick research in profits already.

Thank you Stockopedia!

Dividends reinvested... but in what?

Having the dividends reinvested is a key part of my long-term strategy and I've received a decent £288.63 in the last quarter, with more expected in the next few days.

Immediately, I got an email from the online broker asking whether I wanted the dividends reinvested automatically, but this was only possible in certain stocks (ironically the less impressive ones) through the equivalent of a DRIP system.

I therefore took the decision not to have the dividends reinvested automatically at all, and to assess where to have my re-invest this cash each and every time I purchase stock. After all, I figured, why would I blindly buy more of a stock without assessing its likelihood of success from this point on?

The Flash Crash turned out to be a lucky opportunity:

I'm particularly happy with these results since they included a severe blip in the market.

Although it turned out to be less severe than the first few minutes suggested, the February 5th 2018 flash crash lowered prices on the London stock exchange but - ironically - my lack of attention to the market over the previous 8 months served as a bit of a bonus here.

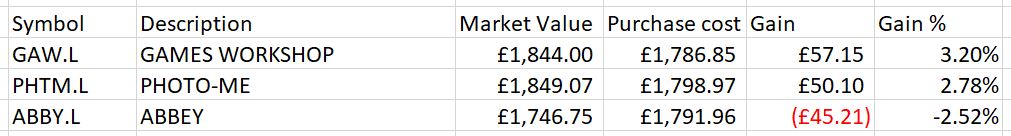

I had 8 months worth of money saved up from my monthly investment budget and decided to max out my £20,000 ISA allowance by purchasing additional stock in the cheaper market that resulted from the volatility in New York.

These stocks have since recovered some of their pre-crash value and that's been upside for me.

Here are the stocks I decided to go with and their prices today (already showing a small rise!):

In Summary

So - 26% up in 6 months - I must be a genius, right?

NO! NO! NO!

The overriding feelings I have are that I've been lucky.

That said, the London (FTSE 100) market dropped 3.8% in the same period, so there's something going on! I'm delighted that the recommendations thrown up by Stockopedia turned out to be good ones and that the combination has grown handsomely.

However, I've got my dividend-guru buddy Mike's words ringing in my ears that I must be an investor not a speculator, and view my stock purchases as investing in the businesses they represent.

This seems like a good thought to keep my feet on the ground. Deep down, I doubt that those businesses have increased their profitability by the 26% it would take to put them on such an insane upward trend.

Having received dividend payments representing approximately an annualized 4% yield and seeing those dividends reinvested feels more believable as a long term growth strategy than the frothy uptick of the stock prices and this above all re-assures me that my goals of a decent retirement income within 15 years might well be achievable.

I'm doing my very best to keep my reality filter on. I'm pretty sure that there'll be more corrections to come and that my stocks won't always be winners!

I'll report more in the coming months!

By the way ...

Getting my own thinking straight and sticking to my commitments is one of the reasons for this blog. I've now read in many places that writing about your investments helps by making you consistently question why you're doing what you're doing. (If you're in a similar position, feel free to add discuss your situation to the comments at the bottom of this page).

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.