Compound Interest - the Secret to Wealth!

This is what Albert Einstein reputedly said about compound interest and your job as an investor should be to harness it and have it working in your favor.

Simply put, compound interest means earning interest on interest. It is a very powerful force and is the reason why Warren Buffett is so rich or why the rich just keep getting richer. Why not emulate them!

Simple interest vs. Compound interest

Simple interest is what you earn on your initial investment, known as the "principal". For example, if you earn 10% on $10,000, you will have $11,000 after year 1 and this additional $1,000 is the simple interest.

But after year 2, you will have $12,100 as you earn not just the 10% simple interest, but $100 extra - 10% on the extra $1,000 that you earned from year 1. This is your compound interest.

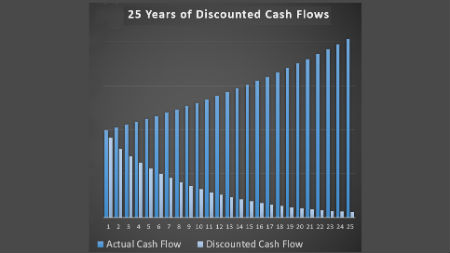

The effects of compound interest seem small in the early years but be patient! Over a long period of time this "interest on interest" will pay you far more than the simple interest as you can see in the examples further down this page.

Alice Schroeder's excellent biography of Warren Buffett is titled "The Snowball". Buffett is quoted in this as saying "Life is like a snowball. The important thing is finding wet snow and a really long hill."

This quote from Buffett describes compound interest.

The wet snow means finding investments with high rates of return and the long hill refers to the time you spend holding those investment. This is best illustrated with a couple of examples below:

Example 1 - The importance of time (the long hill).

Jack and Judy are twins. They graduate from college at the age of 21 and take a different view to saving.

Judy wants to start saving $10,000 per year on graduation and will then stop after 10 years. She will, however, leave her savings alone until retirement at the age of 67.

Jack also wants to retire at 67 but he thinks your 20s are for living it up. He'll start saving after 10 years and will continue saving the same $10,000 every year between the ages of 30 and 67.

They both manage to invest at exactly 10% per year.

Who ends up wealthier?

Let's see their wealth at selected ages:

|

Age |

Judy |

Jack |

Judy only saved for 10 years and saved a total $100,000 in that time and she ended up with $5.419 million!

Jack, however, saved for 37 years and saved a total of $370,000. He ended up with $3.30 million - not bad but Judy ended up $2.119 million richer!

This example perfectly illustrates how important time is (the long hill!) in compound interest and boosting your wealth.

Example 2 - Rates of return (the wet snow)

Another set of twins, Peter and Paula, both start saving at the age of 21.

They manage to save $10,000 per year all the way through to the age of 67. They both get very good rates of return.

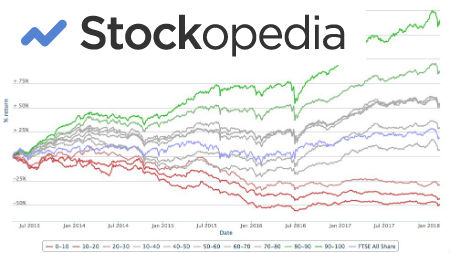

Paula manages 10% a year. Peter, though, manages to get 12% a year - just 2% more as he manages to keep his costs and taxes lower.

Let's see how they are doing at the same selected ages:

|

Age 21 |

Paula (10% return) $10,000 |

Peter (12% return) $10,000 |

So with "just" 2% more per year, Peter has ended up $8.34 million richer! Of course, 10% and 12% returns, over such a long period of time are good returns, but the nominal (inflation included) average of the overall stock market since World War II is roughly 11%, so these examples are by no means unrealistic.

What is important from this example, though, is that small differences are magnified enormously in the long run. This means you should look to keep your costs as low as possible, invest in tax sheltered accounts such as an IRA, Roth IRA, or 401k as much as possible, try to defer your capital gains taxes, and aim to earn the highest rate of return for as long a period of time as you can.

Hopefully, you can now see why a master investor such as Warren Buffett, who has been earning around 20% a year for a long period of time, is so wealthy.

As you can see from these examples, it's hard to get rich quickly by investing in stocks, but very possible to get rich if you have a long period of time and use compound interest effectively. We would advise you to get saving as soon as you can and then keep re-investing the dividends and any capital gains you make to harness its power effectively.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.

What Other Visitors Have Said

Click below to see contributions from other visitors to this page...

Dividends and sequence risk

Q: With sequence of returns risk being a major threat to retirement success, can dividend income address sequence risk? Why or why not?

Mike from RetireOnDividends.com …