Beating the index as a rookie...

(I've just managed it by 23%!)

Is beating the index possible as a stock trading rookie possible or realistic?

As you'll know if you've read my other posts, I'd never bought a share before July 2017, and I'm trying to develop a pot big enough over the course of 15 years to provide a retirement income from dividends.

The London FTSE-100 total returns with all dividends reinvested have averaged 8.7% per year since 1983, which means that mirroring the index would be enough to double your money just over every 8 years. In order for me to reach my retirement target of a portfolio worth £1,000,000+ within 15 years I need a slightly higher return than this to reach my goal.

My wife and I just cashed in on a property renovation project and will be putting these gains into stocks over the next 2-3 years via the UK ISA system which allows £20,000 per year per person to be invested and capital gains and dividends to be taken tax free.

Despite this advantageous investing vehicle, I've got to be beating the index - very slightly - to reach my goal.

How realistic is that for a beginner like me? Surely only top pros are beating the index consistently?

Well... who would have guessed it... my Stockopedia inspired portfolio has continued to post decent numbers despite media coverage over the last 3 months (Feb-Apr 2018) announcing "The Return of Volitility" (see here and here).

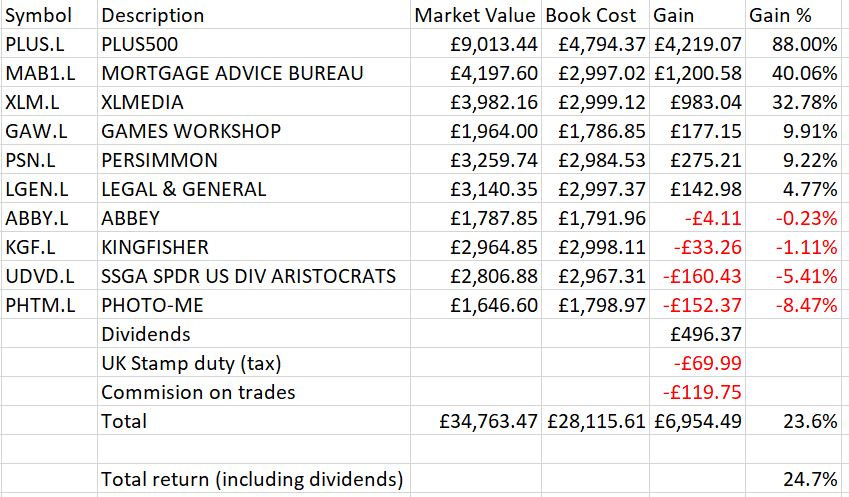

Here are the figures - This is the state of my portfolio as of today (18th April 2018):

A 23.6% capital growth and 24.7% total return in just under 9 months sounds (and is) fantastic, but it looks even better when you compare it with the FTSE-100 to see if it's been beating the index...

In a similar period since 23rd July 2017, the London FTSE 100 went up and down like a yo-yo, starting at 7,377 and ended yesterday down 60 points at 7,317.

Here's the chart for that period...

It was time to fasten your seatbelts for a bumpy ride!

And my portfolio? Well, while trying not to get carried away and not to get horribly smug, I'm completely thrilled with the results!

During this period I've smashed the index!

If I can have one-fifth of that sort of result over the next 15 years my retirement might be earlier and more stylish than I expected!

However, I can see that getting over-excited and becoming unrealistic could easily be a problem here, so I wrote to my investing mentor, Mike Roberts, to ask a couple of questions and his answers were fascinating, so I thought I'd share them with you below:

1. Are my results purely a fluke? Is it possible that I could keep beating the index, by - let's say - 5% per year over the next 15 years? What sort of returns have you managed, when averaged out over time?

Will - your results are fantastic so far and to be comfortably beating the index in the time you've been investing has clearly boosted your confidence. I'm going to give you some cautious advice though (you can call be boring...!)

Firstly, if you invest for a long period of time (at least 25 years) then I can guarantee that there will be times when it will go very well (both relative to the index and in terms of absolute "profits" you're making) and there will also be times when it is going badly.

Think of it like a game of golf in which you've birdied the first three holes - that's great but it won't last forever! Keep your emotions in check during good and bad times. It is just as important not to get too down when things are not going well just like you try to stay even keeled after a double bogey on the golf course.

Secondly, remember that beating the index over an extended period is a terrific result. Nearly all professional investors do not! So make sure you don't set your goals too high and get too greedy.

That said, private investors do have several advantages over professionals (believe it or not!). Most fund managers under-perform due to costs yet you won't have to pay these costs. The costs of owning a professionally managed fund include the sales charge and expense ratio which go towards financial intermediaries as well as paying the manager / research / marketing / accounting / custody etc.

Doing the investing yourself means you'll only need to pay for dealing charges and taxes (plus any expense you have in your own research).

Another huge advantage you have over the professionals is that it's very hard for the pros to avoid "herd" mentality. Due to redemptions in weak markets, they often have to sell at market lows and, more importantly, it is very hard to make contrarian or unpopular stock picks when you are answerable to a boss. This means they are often motivated to buy "popular" stocks that are over priced and lower future returns.

Professional investors also have a huge incentive to "hug" the index (meaning they just buy the stocks in the index with similar weightings). This is because their motivation is to keep their job.

If they stray a long way from the index and are beating the index in the short term then they don't receive much credit but if they underperform badly then they will be fired. As an individual investor you don't have these pressures which means you can look at more unpopular stocks and be more patient.

As for my performance... I have been tracking my own returns since 2013 and was actually outperforming the index by 5% per year until this year. I am underperforming this year so my overall outperformance has dropped to about 4% per year - still not bad but I haven't measured it over a long enough period to really pay attention. What really matters is the underlying performance of the businesses (stocks) I own. If they do well then over time I will do well.

2. Do you have tips for dividend investors in volatile markets? Is timing your purchases for the down periods in the market a good idea?

I like volatile markets as this will often present more opportunities and give you a better chance of beating the index.

I do not worry about volatility at all and never try to time my purchases. If l like the stock and like the price then I just buy it. I don't worry about what the market will do after that and make no attempt to predict it.

If you were to buy an apartment or a house you wouldn't call the realtor for a quote on the value of it the next week and I don't really care what the market says about the stock price the next week. I do, however, look to the asset itself to produce returns for me (through earnings and dividends) so do focus on how the company is actually performing.

Clearly if the market is going down it is more likely to throw more interesting opportunities for me to make investments so I do pay attention. In an ideal world I would be purchasing high quality companies at good prices and you are more likely to get that in weak markets.

Therefore I'm very happy to see markets falling as it gives me more opportunities. As a net buyer, you should embrace falling markets in the same way you are happy when your supermarket cuts grocery prices.

There is an old saying that time in the market is more important than timing the market. This is worth remembering especially as some of the biggest up days in stock market history have come just after a crash.

At the end of the day, you want to be in a position where you just keep buying productive assets. This is your route to riches and is very well described in this article.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.