Price to Earnings Growth Ratio

The Price to Earnings Growth Ratio (PEG) should sit alongside other metrics you use to analyse a business (for example the price/earnings ratio, the price to book ratio & the dividend yield). The PEG is especially highly regarded by followers of Jim Slater's Zulu Principle of investing, but what is this ratio and how useful is it?

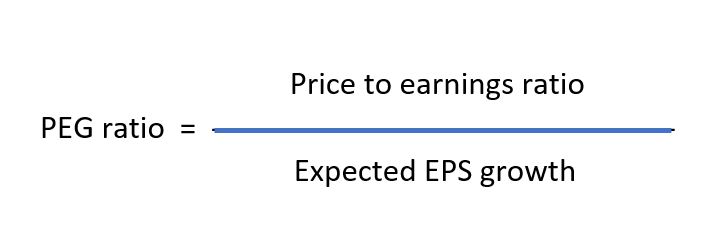

The Price to Earnings Growth ratio is a formula that tries to balance the price of a stock with its expected growth. To understand how to use the PEG ratio, you have to understand what Price/Earnings (P/E) represents. If you're not sure, click here.

Why would you ever buy a stock with a high P/E ratio?

Well, this is where the Price to Earnings Growth ratio comes in. The drawback with P/E ratios is that it fails to take into account growth.

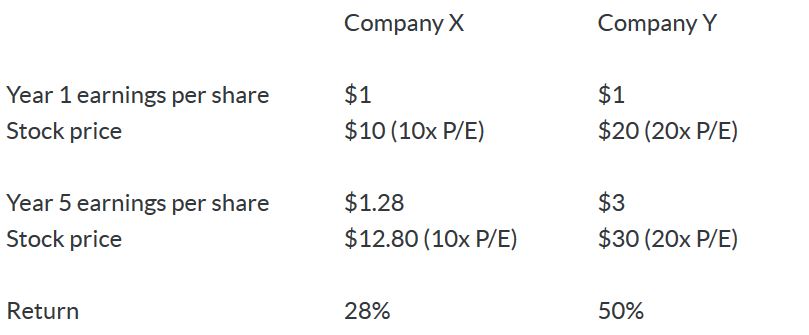

Just imagine that company Y (p/e ratio of 20) manages to triple its earnings over the next five years (growth of just over 24% per year), yet company X's earnings only grow by "just" 28% (roughly 5% per year).

Company Y is now earning 134% more than company X, so even if its valuation drops in half so they now trade on a the same P/E ratio, then company Y will have a stock price that has outperformed company X. Company Y's stock has increased 50% in value (from $20 - $30) while Company X's stock "only" increased by 28% (from $10 - $12.80).

This is illustrated below:

The Price to Earnings Growth ratio can help you as it attempts to balance both the P/E ratio and the stocks growth rate over a period of time. The formula is the Price/Earnings ratio (P/E) divided by the earnings growth rate over that time frame (usually the preceding 12 months). For example, if Company A is expected to grow it's earnings per share next year by 20% and the stock is trading on a P/E of 15 then the PEG ratio would be (15/20) = 0.75.

It's a good way of comparing two companies, so if company B had a P/E ratio of 12 and its expected earnings growth over the coming year is 10% then the Price to Earnings Growth ratio would be 1.2. Using the PEG ratio, company B would be the more expensive despite the lower P/E ratio.

Peter Lynch in his book {One up on Wall Street} suggested that a PEG ratio of 1 is a fair valuation for a company (ie. the P/E ratio equal to the expected earnings growth percentage). If a company has a PEG of less than 1, then it could be considered cheap and therefore worth further investigation.

Are there any drawbacks to the Price to Earnings Growth ratio?

Just like any other financial ratio, however, the PEG ratio has its limitations.

This is why you should never take one ratio in isolation - instead, look at several ratios and try to get a good understanding of the overall business before you make any investment decisions.

The main flaw to the PEG ratio in our opinion is that assumptions about growth can be unreliable. Different authorities calculate this, and therefore the PEG differently and the only truly reliable statement about growth is that nobody knows how fast growth is going to be for any given company in any given year.

This is especially true over a longer period of time. I don't think most salary earners could tell you what their salary will be in 5 years time, so trying to work out a company's earnings in the future is hard enough (we'd argue impossible). This limits the uselfulness of the PEG ratio as future growth rates are uncertain.

The PEG ratio is often not a useful metric for evaluating very fast growing or very slow growing companies. A very fast growing company is unlikely to keep up that fast growth, so therefore the PEG ratio assumptions will likely be more speculative.

For very slow growing companies, the PEG ratio coupled with Peter Lynch's theory is certainly going to be deceiving. For example, a company with earnings growth of 1% is clearly worth more than a P/E ratio of 1.

In his book "Security Analysis", Ben Graham indicated no-growth companies should probably have a P/E ratio of around 8.

This can be a very helpful benchmark, against which to measure a company, but be aware that these metrics vary greatly depending on the interest rate environment and relative valuations at any given time.

Click here to find out more about PEG ratio.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.