Use Discounted Cash Flow to value stocks

How to start an explanation of how to use discounted cash flow to value stocks? With a quote from Warren Buffett of course:

"Any investment is worth all the cash you're going to get out between now and judgment day discounted back."

This shows just how valuable the Oracle from Omaha (Buffett) considers "Discounted Cash Flow" in estimating the value of a stock or other investment.

This page will attempt how to use Discounted Cash Flow to value stocks, show the calculation, examine why it is useful, and discuss any drawbacks to it.

How and why do analysts use discounted Cash Flow to value stocks?

A fundamental question here: Why do you make an stock market investment?

The reason is to enhance your purchasing power in the future. If your purchasing power doesn't grow in years to come then you might as well spend the money now. An investment is only of value if it generates cash for you in the future. Obviously the first place to look for income from a stock is at the dividend.

Some stocks pay a dividend now and many are expected to start paying one or to pay a higher one in the future, so there is a value attached to them. It is important to remember, though, that receiving cash now is more valuable than receiving it in the future due to the time value of money.

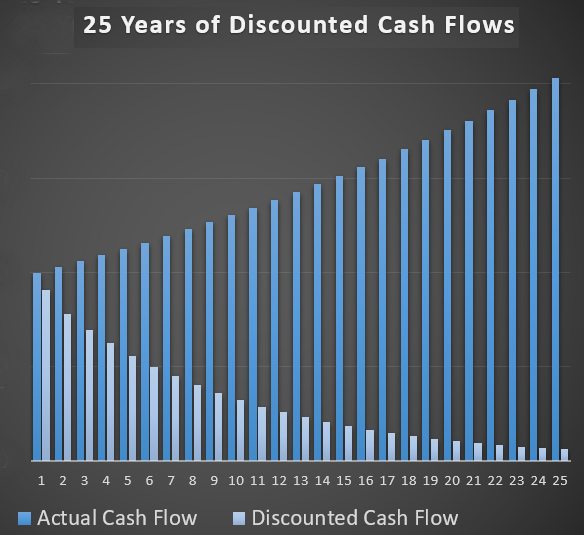

By using the Discounted Cash Flow to value stocks, you're essentially working out the value of the cash (or payback) you receive in the future in today's money.

Indeed, Discounted Cash Flow can be used to attempt to value any project or asset that is expected to generate cash for you in the future. It's the sum of all future free cash flows discounted back to a present day value.

For valuing stocks, it's important to understand exactly what "free" cash flow is because that's the figure you normally start with.

Free cash flow is all the operating cash generated by a company with depreciation and amortization added and the capital expenditure subtracted. For more information on this, please see our page on the cashflow statement.

Some Discounted Cash Flow calculators may ask you to input the earnings per share (EPS) rather than the free cashflow per share.

So that's the "cash flow" part but what does the discounted bit mean?

As we've mentioned, a dollar received now is more valuable than a dollar you'll receive in five years' time.

To use discounted cash flow to value stocks' dividend payments to you in, say, five years' time, you'll need to select a discount rate.

The discount rate is normally a rate over the risk free rate that will give you an acceptable return. For example if the risk free rate (which is normally close to the interest rate) is at 2% and you want a premium of 4% over that rate then the discount rate will be 6%. The discount rate is sometimes referred to as the weighted average cost of capital (WACC).

Let's illustrate with an example. In the example, we will show the value of $1,000 today over the next 5 years using a discount rate of 6%:

|

Year 0 |

Present value at 6% discount rate $1,000 |

You can then add up all the discounted cashflows to value stocks in the form of a NET PRESENT VALUE (NPV). This means that the calculation for the discounted cashflow can be represented by this rather complicated formula:

NPV = CF1/(1+dr) + CF2/(1+dr)^2 + CF3/(1+dr)^3 + CF4/(1+dr)^4 + CF5/(1+dr)^5 + .....[TCF/(dr-tg)]/(1+tg)^n-1

Where:

CFi = Cashflow in year i

dr = Discount Rate

TCF = Terminal Year Cashflow

tg = Terminal growth rate

n = number of years

Seems complicated? It is a little, but luckily there are calculators to do the work for you. Here's a good one: https://www.omnicalculator.com/finance/dcf#what-is-dcf

Are there drawbacks to calculating the Discounted Cash Flow?

The attraction when you use discounted cash flow to value stocks is that it seems to give another measure for an objective, quantitative valuation of a company.

But there are some problems with it. The first major one is selecting an appropriate discount rate to use.

The discount rate has to be tied to interest rates and so if interest rates rise then your discount rate should rise. This will lower the value of future cashflows which will lower the net present value or intrinsic value.

Sadly, of course, you cannot entirely accurately predict future interest rates.

And therein lies the crux of the drawbacks to discounted cash flow: you are trying to forecast the future.

If you could precisely forecast cashflows, growth rates, and interest rates (giving you a more certain discount rate) then the calculation would be extremely valuable. It is, however, impossible to consistently and precisely make these predictions which means there are serious limitations to the use of discounted cash flow to value stocks.

That's not to say it's entirely useless, though.

Our advice would be to use very cautious assumptions - maybe use quite a lofty discount rate and very conservative growth rates (in particular the terminal growth rate). That way you are less likely to get nasty surprises.

We would then advise you to use discounted cash flow to value stocks along with a number of other valuation measures. You should also think about the P/E ratio, free cashflow yield, balance sheet strength, returns on equity and capital, dividend yield etc.

You'll also want to think about more qualitative (business, industry, product, management, etc) factors to help you in your investment decisions. For more information on finding dividend paying stocks at reasonable prices, see our page on key lessons and investing metrics.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.