Like so many things in investing there really isn't a right or wrong answer to the age-old "dividend or capital growth" question.

It would have been a huge mistake to sell out of Berkshire Hathaway in 1969 (they paid their last dividend in 1968) because they were no longer a dividend payer. When assessing whether you should invest for dividends or capital growth there are several things you may wish to consider. I'll touch on them below:

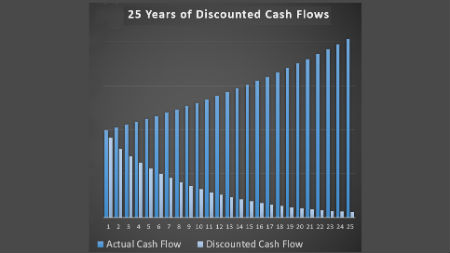

First of all you need to define why you are investing. The whole point of investing is to increase the purchasing power of your initial investment over time. Otherwise, there is no point in investing. You might as well spend the cash now. You need to make a high enough return to make the sacrifice of not spending now worthwhile.

At the end of the day what really matters when investing in the stock market is TOTAL SHAREHOLDER RETURN. This is simply your return from dividends and capital gains added together. In a perfectly rational world, you should be completely indifferent as to whether that return comes from dividends or capital growth.

Unfortunately this is not a perfectly rational world. There are numerous other factors to consider.

Dividends or Capital Growth considerations:

1. Tax efficiency

In many

countries, dividends are taxed at different levels to capital gains.

There may also be allowances . In your case, Will, as you live in the UK

there is a capital gains tax allowance of £11,300 (2017-18) meaning you

can make up to that much without paying a penny of capital gains tax.

There is also a dividend allowance of £5,000 (proposed to be reduced to

£2,000 next year) which means you can earn up to that much without

paying a penny of dividend taxes. That is assuming you haven't used a

tax advantaged account like an ISA (UK equivalent to a Roth IRA) or a

pension.

This means that you can shelter an awful lot of your

investments away from tax and you may well be able to (legally) avoid

tax altogether.

Looking at UK rules, you can contribute up to £20,000

per year in ISA accounts and £40,000 per year into a pension account

(although this reduces if your earnings get very high).

If you're married, you should be

able to do this for a spouse as well, meaning you can double those

allowances. So unless your portfolio is very large, you should be able

to avoid investment taxes completely.

If your investments are in

tax free accounts, then you should be completely indifferent as to

whether you earn from dividends or capital gains.

2. Overall health of the business

When you invest in stocks, you're

investing in the underlying business. As you are a partial owner of the

business then you are entitle to your share of the profits.

Profits tend

to be paid to shareholders in the form of dividends, although share

buybacks are a possibility. Have a read of our page for you more

information on share buybacks.

What

I like to think about is, if management are not going to pay you

dividends then what are they doing with the earnings? There could be

several reasons for not paying dividends. Management may wish to use the

cash for debt reduction, for capital expenditure, for acquisitions or

for share buybacks.

All of these actions should increase your share of

the value of the company over time which, should, ultimately increase

the share price. You have to ask yourself if these actions from

management are preferable to paying out the cash in dividends.

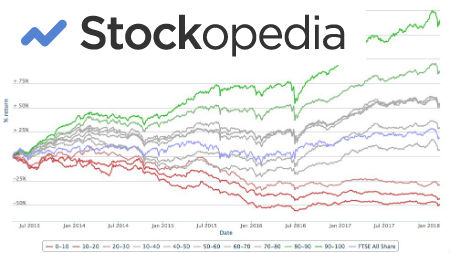

3. Something to remember: Dividend paying companies often outperform others.

There

have been several studies that show that dividend paying stocks tend to

perform better in the long run than non-dividend-paying stocks over long periods of time, and - all other things being equal - this should guide you in the choices you make about searching for dividends or capital growth. Have a look at this excellent paper from Tweedy

Browne Company LLC on this topic - it's the clearest explanation I've seen.

Why

might dividend stocks outperform? I believe the main reason is that

paying out more of your earnings means greater capital discipline. If

you only have $5 in your wallet as opposed to $500 then you are going to

be more likely to spend that money carefully and not waste it.It is

the same with large companies.

A lot of cash in their treasury often lead s

to wasteful spending on things like overpriced acquisitions, share

buybacks at too high a price or wasteful R&D. Paying out

the cash means they have to be more efficient and disciplined with

their capital and this should mean higher returns on equity.

Another

reason for possible outperformance by dividend stocks is that those

companies that pay dividends tend to have better quality earnings.

What

do we mean by that? Well to pay dividends, the company has to be

generating cash consistently, so there is probably a bigger focus on cashflow.

Earnings (an accounting term) can be "manipulated" more easily using all sorts of tricks such

as changing the definition of expenses to capital expenditure or

re-valuing assets on the balance sheet. It is far harder to "fake"

cashflow (the true amount of money coming into the company) and this cashflow is what is generally behind dividend payments.

Ultimately

if you find a management that has proven it has excellent capital

allocation skills then you should be totally indifferent as to whether

you earn your returns from dividends or capital growth.

Of course, it

will be up to you to assess your tax situation and work out how to

maximize your post tax returns. If you find an excellent company that

has a management that are excellent operators but not necessarily great

capital allocators then you would want them to return the capital back to

you as a shareholder.