The Disadvantages of Dividends

What are the disadvantages of dividends? Some big-name companies choose not to pay them, so do they always make sense and why do some avoid payouts?

(To read about the advantages of dividend payouts, click here!)

1) Tax! (Without doubt the most frustrating of the disadvantages of dividends)

There are two distinct disadvantages of dividends from a tax perspective...

The first and most obvious is that, from an investors point of view, it creates a double taxation that wouldn't occur if the earnings were retained.

This is because a company that makes a profit normally has to pay corporation tax. Dividends are then distributed from their after tax earnings. The investor is then also usually liable to pay tax themselves, resulting in this double taxation.

Of course, tax rates can vary depending on the investor's personal situation and investors can avoid or reduce (legally!) dividend taxes by using tax sheltered accounts such as a 401k, traditional IRA (Individual Retirement Account) or Roth IRA.

If the retained earnings were not paid out as dividends then the full amount (not just the post tax amount) could be used by the company for other earnings enhancing actions such as share buybacks, acquisitions, paying down debt or investing in organic growth.

For example, in effect you're better off if the company you own stock in retains its profits to buyback its own shares rather than pay you a dividend, only for you to reinvest the shares in the same company. This is because you may have to pay tax on the dividends you were paid creating a "tax wedge".

The second of the tax disadvantages of dividends isn't so obvious. Sometimes dividend paying companies will tap investors to raise cash or fresh equity. This makes no sense from a tax perspective for the investor as you are paid a dividend and then, in turn, the company comes to you to ask for cash in a rights issue.

If you subscribe to the rights issue, you pay tax on your dividends and then send the cash back (the amount can vary depending on the size of the rights issue) to the company for them to invest. This creates an unnecessary tax wedge which would be avoided if the company had simply retained their earnings. If you do not subscribe to the rights issue then you will be diluted which would also leave you worse off.

If you're still unhappy about tax (you're probably not alone!) then you can read more about tax on dividends here.

2) You may not be able to invest the cash as well as the company

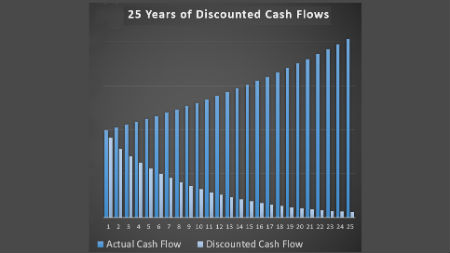

If you have invested in a company that earns very high returns on its invested capital then often you, as the investor, would be far better off if they retained that cash to continue earning those high rates of return.

If you are paid a dividend and can't invest that cash as effectively as the company that paid you then you are likely to be worse off in the long run. Often the very best investments are those of companies that consistently earn very high returns on their capital and you want as much of your capital as you can get working for you in that company.

3) The company can't find a use for the cash

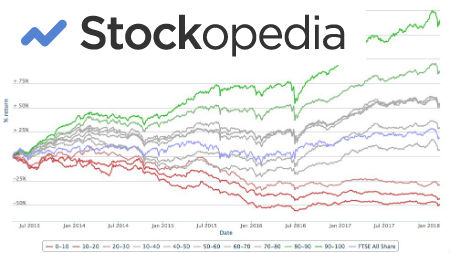

One often forgotten disadvantages of dividends is that paying out a large share of earnings to shareholders could signal that the company doesn't have any ideas for its cash.

Whilst a payout here is probably more beneficial than the cash spent in an ill-disciplined way, the fact that the company doesn't know what to do with the cash could send a poor signal about future returns of the business and management's ability to earn good returns in the future.

This could be a long term negative for the company and you should look into this carefully, especially if the stock trades on a high valuation.

4) Management wedded to the dividend could miss some investment/acquisition opportunities

This is somewhat linked to point 2 above. If the management of the company are so determined to keep up payments to shareholders, then it could make it more difficult for the company to pursue excellent opportunities that would benefit shareholders as the funds would have been distributed.

Management of dividend paying companies may also leverage up the balance sheet more aggressively to fund these opportunities, therefore making the company riskier than if that expansion had been funded by the cash that was paid out to shareholders.

5) Not all investors are the same!

This was a point made by Warren Buffett in his 2012 letter to shareholders (on page 19). He argued that investors who needed income could realize the right amount of income from their portfolio by selling the correct amount of shares each year. Dividends don't give that flexibility as they are paid on a per share basis and so some investors are actually receiving more cash than they need!

If you're not yet retired, chances are you don't need income at this stage and so the payment of dividends simply means that you have to find new places to invest that cash. As mentioned above in point 2, these investors may well be better off if the company retained the cash and invested it for them.

For a very good write up on some of the disadvantages of dividends, have a look at Warren Buffett's 2012 letter to shareholders - see page 19!

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.