The Top 5 "Tips to Help Me Save"

Good "tips to help me save" can be the difference between winding up rich and winding up broke. Save consistently and invest and you'll end up winning the financial game of life, but overspend or get caught in a cycle of debt and you'll lose.

The first step to successful investing is actually having the money to invest. With the exception of getting lucky with a lottery win or an inheritance, we all have to build up the cash to invest ourselves.

This does take some self-discipline and organisation, but many people world wide are saving for the long term in such a way that they'll soon be able to work solely for pleasure or not at all if they choose to!

Fortunately with the following 5 "tips to help me save", you can make the savings process easier and even automatic:

"Tips to Help Me Save" #1:

Pay Yourself (in other words: your investment fund) First

Most of us naturally view saving as an after thought. We just put whatever money is left at the end of the month (usually not much!) into a savings account or a coin jar. Usually that's not very much - certainly not enough to build a sizeable retirement pot.

To help you get ahead, however, you have to be a whole lot more serious and methodical about your saving. The best advice is to commit to putting cash into a savings or investment account THE DAY AFTER YOU GET PAID.

Think about how much you need to live every month and put any amount over and above this into a savings or investment account straight away by automatic transfer the day after your paycheck arrives. This will guarantee you a consistent savings habit and removes the need for self discipline. It also means that you're forced to live on a tighter budget and so therefore likely to think more carefully about your expenditure and be less likely to waste cash.

This step is highlighted by George S. Clason in his timeless classic {"The Richest Man In Babylon"} where he states under the first law of gold "Gold cometh gladly and in increasing quantity to any man who will put by not less than one-tenth of his earnings to create an estate for his future and that of his family."

Clearly the more you put away the better!

The famous money saving site "My Money Mustache" has shown that if you can save 75% of your take home pay then you'll be able to retire in seven years. Click here for the article in full if you're starting from scratch.

This is probably beyond most of us - we've still got bills to pay and mouths to feed, but it makes the point.

"Tips to Help Me Save" #2:

Live Close to Your Work

Money saving websites and books such as The Millionaire Next Door are full of fantastic ideas on how to live frugally and much of their focus is on cutting the small expenditures such as your daily coffee or your cell phone bill. Whilst these are important, don't forget the big costs such as your house, education and travel.

On the latter, you can make huge savings by living close to work. Your car is likely to be a huge cash drain, with the cost of the car, the repairs, the insurance and the gas (petrol) really adding up over time. If you can live close to work, you might be able to use public transportation, car pool, cycle or even walk to work. All of these can save a lot over a long period.

You can find out more about the high cost of commuting on this page of Mr Money Mustache's site.

"Tips to Help Me Save" #3:

Avoid Credit Card (& other expensive) Debt

There is - in most investors' opinions - good debt and bad debt. Debt secured on assets (the most obvious being a home mortgage) can be fine if the rate is low and the repayments are affordable.

Credit card debt is a different matter. These debts are dangerous due to very high interest costs, often above 20%.

It makes no sense to invest in the stock market if you have credit card debt.

Remember the average nominal (after inflation) return from the stock market after world war II is 11% (according to Jeremy Siegel), and it is virtually impossible over a long period of time to earn over 20% from the stock market year in year out. Therefore if you have credit card debt, make sure you pay it off as soon as possible and don't incur any interest charges!

"Tips to Help Me Save" #4:

Shop Around & Avoid "Bait"

Have you noticed how good companies are at hooking you in with attractive prices and once you are a "loyal" customer, hike up the rates? This was one of the reasons behind the sub prime crisis where lenders offered "teaser" rates that disappeared after a year or two and were then replaced by skyrocketing interest rates.

It happens across many industries, so be careful about getting sucked in by introductory cable TV, insurance, and energy offers. Firms are more than happy to take advantage of your consumer apathy.

Don't let this happen to you! Shop around the market and check the deals you are on now. Price comparison websites are extremely helpful here.

Often you can call up your current providers and threaten to leave unless they match a quote you have with one of their competitors. You'll be amazed at how often they will lower the price and match them. If you keep on doing this, then you could save a fortune over time and let you build up more dollars to save and invest!

"Tips to Help Me Save" #5:

Write Down Everything You Spend

This is linked to "Tips to help me save #4 " above but make sure you think about all your expenditure. There's nothing wrong with spending money when it enhances and improves your life and it is genuinely affordable.

We all need to be aware, though, that every time we spend cash then that is cash that is not going to be producing future income for you. It is a balancing act and there really isn't a right or wrong answer. You just need to be aware of the choices you are making.

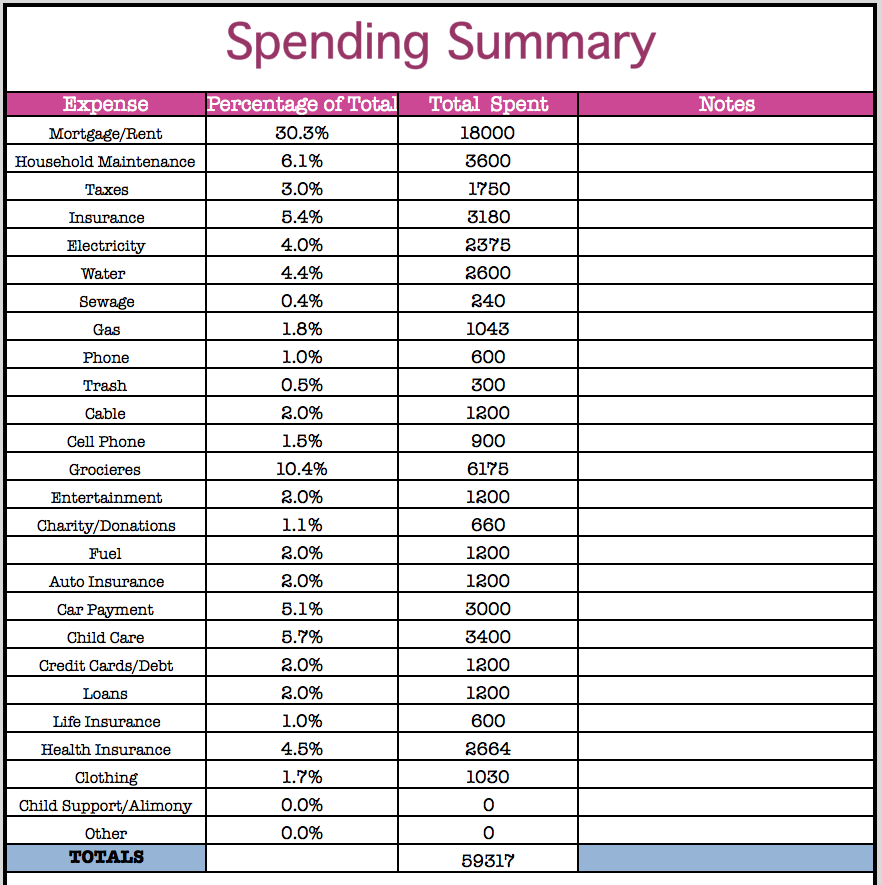

If you feel like you do spend too much or have a habit of impulse buying then a great tip to help you save is to write down everything you spend your money on. This goes from the smallest 50c you might spend on a cookie to the $400,000 you spend on a house.

The very act of writing it down means you'll think harder about your purchases and you'll be able to review your expenditure at the end of every month to see if all those dollars that have left your bank account were really worth it. It can also help you with your budgeting.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.