7 investment warning signs...

Tell-tale signs that a company is a long-term stinker

Wouldn't you hate to miss obvious investment warning signs? In real life you avoid shark-infested waters and you need to do the same with your investing - it's often just as important as knowing what to look for.

Warren Buffet's right-hand man, Charlie Munger, once said that investors need to "invert, always invert" (in other words, consider the downsides). He said "All I want to know is where I'm going to die so I don't go there." Maybe you should do the same with your investments.

Here are the top 7 investment warning signs that show you the company you're looking at could be a long term stinker. If you see any of these, then you probably want to re-think your investment.

Investment warning signs #1

The company is highly indebted

Over a long period of time all businesses will go through difficult times. A highly indebted company is less likely to have the flexibility or headroom to be able to get through those tough times. Any slight downturn in trading can lead to bank covenants being breached and lenders demanding repayment. This is often followed by a sharp decline in the share price and could result in extreme dilution or total destruction of all shareholder value.

Stick with companies that have no debt or debt they can pay off quickly. If you are determined to go for a more indebted company, then make sure it has consistent or sticky revenues and ideally uses the bond markets rather than bank debt due to the longer maturities you typically get from bonds. Larger companies tend to use bonds whereas smaller companies are more likely to have bank debt.

Investment warning signs #2

The company operates in a sector that's always changing

What type of cell phone will you have in 20 years? Will you still have a desktop computer? How will you do your shopping? How will you travel? History is littered with companies that failed to change with the changing times. Polaroid, Kodak, Nokia, Blackberry are examples from relatively recent times. Going further back, being a candle maker was quite lucrative until Thomas Edison came along. A saddler was a common occupation until Henry Ford started mass producing cars to replace those horses.

You want to find businesses that are unlikely to change all that much. All businesses must evolve but, in an ideal world, you will find businesses selling similar products in the future to what they're selling now. Twenty years from now, people will probably still be eating, drinking, taking medicines, banking, buying insurance, and participating in leisure activities. Sticking to more predictable investments helps lowers your chances of making a serious mistake.

Investment warning signs #3

Management have little ownership

You really want to find management teams who are happy to eat their own cooking. High levels of share ownership among directors means their interests are aligned with yours. They're more likely to be good guardians of your cash because their cash is there too. This means they are more likely to invest for the long term, not get too concerned with what analysts are saying, less likely to pursue value destroying acquisitions or to build up the size of company for the sake of their ego.

Of course, management with big ownership stakes can still make mistakes or be caught out but generally a lot of inside ownership is beneficial to outside shareholders. We particularly like companies where the founders or original family still have a big stake.

Here's a list that might help find some of these companies: The Top 100 employee owned companies in the US.

Investment warning signs #4

The company has no clear competitive advantage

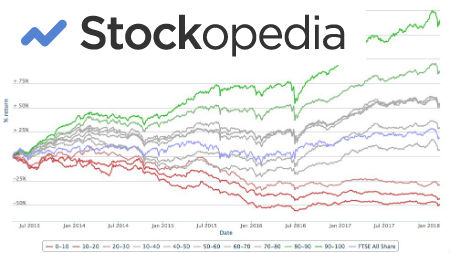

Capitalism is brutal! If you're successful then you will draw the attention of your competitors. They'll try to outwit you, steal your customers or employees, improve on your products, or undercut you. This happens all the time and it's very difficult to fend off for sustained periods unless you have an identifiable competitive advantate. These advantages could include sticky customers, high switching costs, a powerful brand, pricing power, or being a low cost producer.

Investing is a lot easier if your companies have these competitive advantages. It isn't always easy to spot these competitive advantages but clues can include consistently high returns on capital employed and little change in the market share of the leading companies in the field your prospect company works in.

Investment warning signs #5

The company has low returns on capital employed

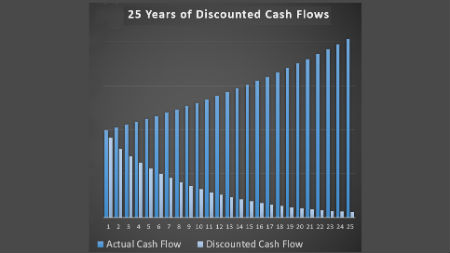

It is very difficult to make a lot of money in the long term if your investment earns a low return on capital. This is the case even if you buy the stock cheap! At the end of the day, you want your money working as hard as possible for you and that means the money that is working for you in the business should be earning a high return. If it isn't, then either that capital needs to be returned to you as quickly as possible or you need to get out of the investment!

It's true that the return on capital employed in the business can change significantly over time. That's why we've said your business needs a clear competitive advantage so it can maintain its high return on capital. If this happens over a long period of time then you're likely to do very well.

Investment warning signs #6

The company destroys value through over priced acquisitions and buybacks

What a management does with the retained earnings of the business is vital to your long term returns. If they're sensible, then they will look for investments offering a high return over a long period of time. A high return is far more difficult if they overpay for an asset. This is particularly important on acquisitions or buybacks as these can involve significant capital outlays. If you suspect ulterior motives to creating the most wealth for shareholders, such as building a business empire or inflating earnings per share so management are paid more, then it is probably best to stay clear.

Investment warning signs #7

The company has little or no free cashflow

Cashflow is really the lifeblood of any business. We've discussed this on our page on the cashflow statement. What you need to focus on is companies with large amounts of free cash - that is cash left over for shareholders after all expenses (including capital expenditure) have been paid. Without free cashflow it is very difficult for a company to sustainably create wealth for its shareholders. Big cash generators, however, can shower shareholders in cash, or use that cash to make sensible investments that will generate even more cash in the future. What is not to like about that!?

If you like this page on investment warning signs, take a look at our resident dividend investment guru's magic filters for selecting potential investments. They're contained in this blog post.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.