Geographic Arbitrage - how dividends can increase your standard of living

One of the best things about retiring on dividends is the ability to exploit geographic arbitrage. What is geographic arbitrage and how does dividend investing help you get there?

The simple definition of arbitrage is to take advantage of pricing differentials, allowing you to profit from the same product in different markets (buy in one market and sell in the other) risk free.

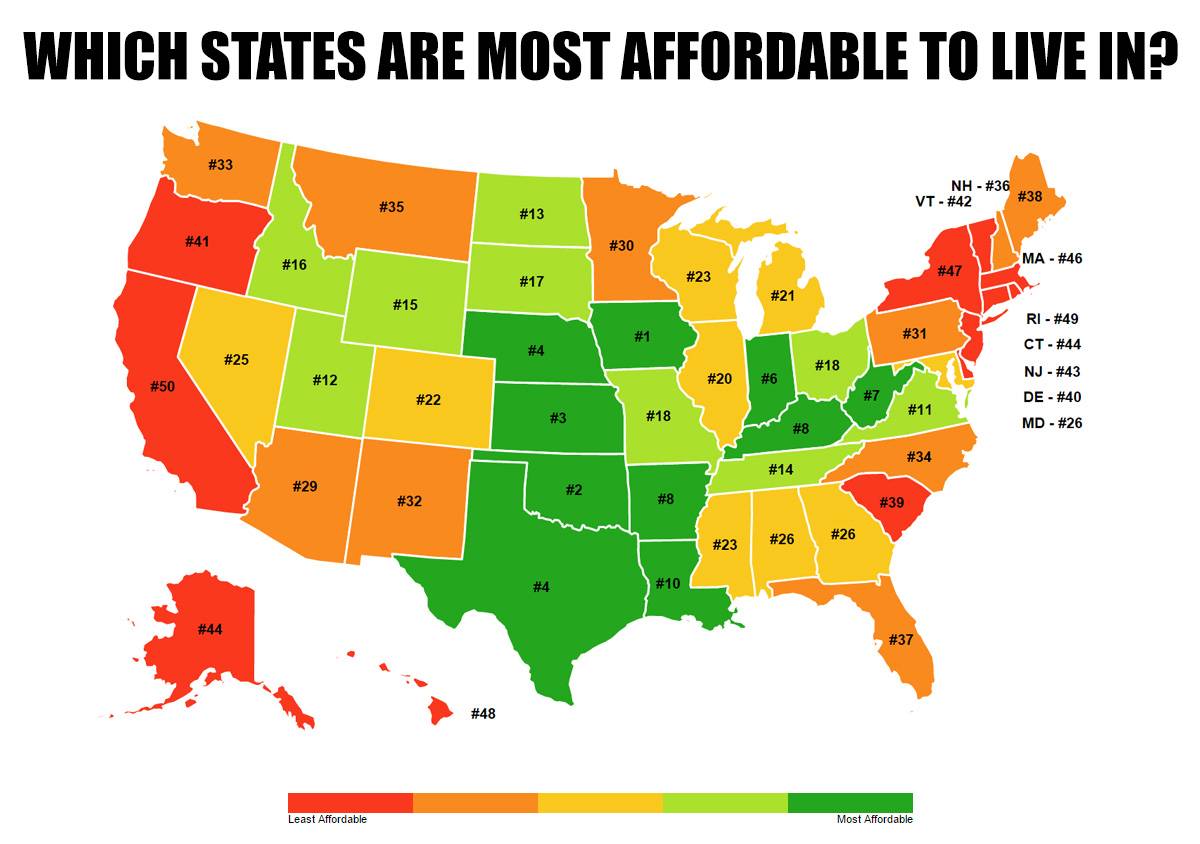

What I'm talking about here is earning a dividend income you earn to build up in a high-cost area (the orange / red states in the map above), but retiring somewhere with lower costs (green states), thus making your money go further.

Financial institutions frequently engage in arbitrage, so why don't you?

Typically they may buy a security (say a bond) in New York and instantly sell the same security at a higher price in Tokyo (assuming they can sell at a higher price after all costs). The difference in the price is the profit that they make risk free. It sounds easy but these trades are difficult to spot and often need to be done in huge size to make it worthwhile. Price inefficiencies (giving you the chance to arbitrage) often don't last for long due prices corrections which take away the arbitrage opportunity.

What is geographic arbitrage?

Geographic arbitrage is slightly different and, we hope, a little more relevant to you. Behind it is the same principle of taking advantage of different markets (living in a cheaper location) with the same product (your dividend or passive income portfolio).

Have you ever thought that it would be pretty cool to earn a typical San Francisco salary yet have the cost of living in some mid western city like Cedar Rapids, Iowa? The great news about dividends is that they don't know where you live! If you own 100,000 shares in Johnson and Johnson then they will send you a check for $84,000 every three months (as of 2017) whether you live in New York City or Huntsville, Alabama.

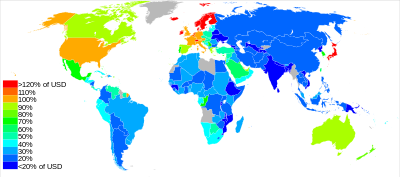

Geographic arbitrage allows you huge freedom of location both at home and abroad. You can spend three months of the year living on the French riviera. Don't like winter? Well why not camp down in Australia or New Zealand between November and March every year to give you the southern hemisphere summer? The cost of living is ridiculously cheap in parts of Asia as well (such as Thailand) which could give you more overseas options. The possibilities are endless and the freedom of living off dividends is incredible.

Take a look at the map below for the relative cost of living in different countries around the world:

Geographic arbitrage isn't limited to just dividends!

Geographic arbitrage isn't just for dividends. All forms of passive income can enable you to take advantage of geographic arbitrage. You can earn from investment properties, bond coupons, royalty income or your own website. In fact, the explosion of the internet has made geographic arbitrage even more popular. All you need is a laptop and an internet connection and you can get to work on earning from a blog or website.

Have you noticed the number of bloggers who come from the mid west? This is not an accident as blogging is effectively more worthwhile in the mid west than on a coastal city. This is because the same amount of effort on your blog will get you paid exactly the same whether you live in Boston or St Louis, yet your cost of living is far lower in St Louis so less of your income is gobbled up by living costs.

How do I work towards geographic arbitrage?

Being able to exploit geographic arbitrage is all about building up your passive income so you can achieve financial independence. Without a large inheritance (or some other lucky break) then you are going to have to build this up yourself.

Unless you’re an S&P 500 CEO it is very difficult to do this quickly but it is possible with sustained self discipline. You need a relentless focus on saving as much of your income as possible: http://www.mrmoneymustache.com/2012/01/13/the-shockingly-simple-math-behind-early-retirement/.

Earn as much as possible from both your main job and think about having a side job or second income stream. Then watch your costs - don't waste money on stupid things that you won't care about in the long run!

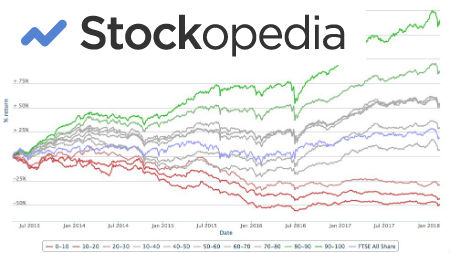

When you have got into a large savings habit then you need to invest wisely for the highest RISK ADJUSTED return. Learn from the best investors. There are loads of Warren Buffett interviews on youtube. His annual letters on the Berkshire Hathaway website are full of great investing tips. Learn from other great past and present investors such as Ben Graham, Charlie Munger, Peter Lynch, Howard Marks, Joel Greenblatt, Philip Fisher, John Templeton, Neil Woodford, Hugh Yarrow etc etc.

Remember that geographic arbitrage is just one of the potential rewards and freedoms you can earn from successful dividend investing. If freedom of location is a dream of yours then we hope it may act as inspiration in your quest for financial independence.

Of course you don’t have to want to move! Many people are very happy where they currently live and have no desire to move to a cheaper location. That isn't a problem but financial independence can deliver many other rewards such as time freedom (no need to work) and diversification of income. We will talk about these elsewhere on this website.

Keep saving and investing!

The RetireOnDividends Team.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.