Focusrite TUNE Dividend

Focusrite TUNE Dividend Factfile

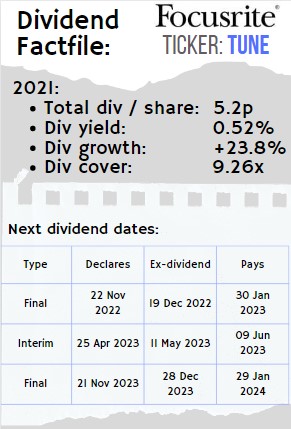

The Focusrite TUNE dividend offered double-digit growth each year from 2017-2021. It is extremely well covered (9.26 times in 2021), but ultimately offers a relatively low yield of just over 0.5%.

Focusrite is a global music and audio products company that develops and markets proprietary hardware and software products used in recording studios by professional and amateur musicians.

In particular they create the audio interface software and hardware which help with the creation of electronic music (think: huge boards of controls and sliders in studios and studio loudspeaker technology). Its first contracts included a commission to work on Beatles Producer George Martin's recording studio.

Focusrite (TUNE) key financial metrics:

Investor's take on Focusrite (TUNE):Focusrite is a company that has built a steady track record since its listing in 2014. It has consistently produced high returns on equity (every year apart from 2020 have been >20%), with minimal debt (in fact it has always reported net cash positions at year end since listing). This is the sign of a high quality company based on its past performance. Other positive features have been steady gross margins, good pre-tax profit and net profit growth (although this has slowed or even fallen lately), and good director ownership with directors (and related parties) holding around 1/3 of the company. It is comforting to know the chefs are eating their own cooking! The company is listed on the smaller AIM Index in the UK but it does have a market capitalisation of almost £600 million, making it a larger company than most on the AIM index (just outside the top 25 at the time of writing). It also has decent geographical spread with most sales coming from EMEA (Europe, Middle East, and Africa) and North America. Many who are making the investment decision will look at valuation, and unsurprisingly, it is more expensive than the average company with its PE ratio quoted in the mid 20s. The dividend yield is also low at barely over 0.5%, although with such high dividend coverage, there should be ample room to continue the group's stated progressive dividend policy into next year and beyond. Although a low dividend yield can be a worry to the value conscious investor, the retained earnings are high (as indicated by the high coverage ratio) and if they can continue to invest these retained earnings and very high rates of return then that should provide some comfort to the investor. Past performance clearly does not guarantee continued future performance and the investor will need to focus on the qualitative aspects and pricing power of the company to get a feel as to whether the returns on equity can be sustained. The high valuation will need continued strong performance to reward the investor but it might be worth remembering the Buffett quote "it's better to buy a great company at a fair price than a fair company at a great price". The challenge to the management will be to continue the great performance of this company well into the future. |

|

Focusrite Factfile:

- Traded on: LSE AIM market

- Founded in 1985

- Went public in 2014

- Number of employees: 449

- Headquartered in: High Wycombe, United Kingdom.

- Directors: Philip Dudderidge (Non-Exec Chair) and Timothy Carroll (CEO) leads a team of 8 further executive and 3 independent non-exec directors. In total 4 of the 13 directors are female.

- Awards: Won prestigious Queen's award for Enterprise in 2022, the third time it as been recognised for strong overseas sales growth.

Focusrite Performance:

Total revenue up from £54.3m to £174m from 2016-2021 although rate slowing dramatically in recent years.

Net profit up from £6.26m to £28.3m from 2016-2021 although increase slowing dramatically and may fall in 2022.

Earnings per share up from 10.7p to 48.2p (2016-2021), although earnings report for H1 announced a fall in April 2022.

Rapid growth in stock price from first listing peaking in 2021 falling approximately 40% by late Spring 2022.

Consistent dividend growth, although dividend yield low (0.6% at time writing).

Dividend cover in 2021: 9.26.

How does Focusrite generate income?

Focusrite is a global music and audio products company that develops and markets proprietary hardware and software products used in recording studios by professional and amateur musicians.

In particular they create the audio interface software and hardware which help with the creation of electronic music (think: huge boards of controls and sliders in studios and studio loudspeaker technology). Its first contracts included a commission to work on Beatles Producer George Martin's recording studio.

Sources of cash flow:

- development of products

- sale of products

- provision of support services

- licensing of its technologies to third-party manufacturers

Focusrite PLC (TUNE) trades under 9 established brands, some of which have long and prestigious histories in this industry: Focusrite, Focusrite Pro, Martin Audio, Optimal Audio, ADAM Audio, Sequential, Linea Research, Novation and Ampify Music.

In short, Focusrite pro brands are among the market leaders delivering audio professionals both products and services which generate a mix of income streams (one-offs and recurring). They are commercial audio brand which provides for a broad market, ranging from medium-sized commercial installations to stadium concert audio, the latter especially following their 2019 acquisition of Martin Audio designs.

Prospects for Growth / Headwinds for Focusrite TUNE dividend:

The company is clearly implementing a growth-by-acquisitions policy. In addition to Martin Audio, they bought Adam Audio studio speaker brand in 2019, Sequential design in 2021 who specialize in analogue synthesizers and Linea Research Holdings in 2022. It continues to have cash reserves and company forecasts for 2022 and 2023 are for c. 8% dividend growth.

That said, Focusrite announced on April 26 2022 that H1 revenue fell 2.5% and basic earnings per share were also down (23.1p). They did however announce an interim dividend of 1.85p.

For more info on the Focusrite TUNE dividend, visit the company's investor relations pages: https://focusriteplc.com/investors/reports-presentations

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.