Dividend Aristocrats

Dividend aristocrats are the ultimate dividend payers. These are companies that have proven themselves to pay rising dividends, year after year, through good times and bad.

Many of them are household names and even more are companies that only investors have heard of.

Studies have also shown that these stocks have outperformed the general S&P 500 over long periods of time which shouldn't surprise us given the importance of dividends.

A healthy company pays a large dividend and a healthy company grows consistently!

What are they?

The true definition of a dividend aristocrat is a stock that features in an index of the same name compiled by Standard and Poors (S&P). These are companies that have raised their regular dividends per share* for 25 consecutive years and are listed on the S&P 500 index.

As an investor you can either buy stocks in these individual companies on the back of your own research or you can buy an ETF (exchange traded fund) which largely tracks these dividend-paying stocks.

Owning this S&P ETF gives you two key advantages:

- You get diversification as S&P state that the underlying index must contain at least 40 companies. (If there are fewer than 40 companies in the underlying index then S&P can relax the criteria for being in the index such as reducing the number of years dividends have been raised to 20).

- You get sector diversification as no one sector can result in more than 30% of the index. This makes the dividend aristocrats index very different to typical high yield index trackers which tend to have much higher weightings in sectors such as banks, insurers, energy and utility companies.

Long term performance

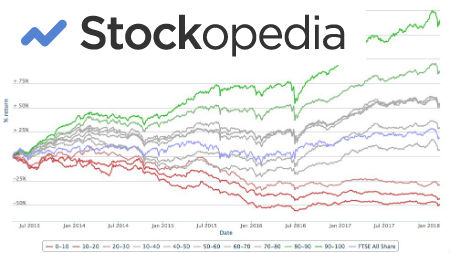

Looking at the latest factsheet from S&P, we can see that the dividend aristocrat index has given a total 10-year annualized return of 10.81% against a 6.74% return from the S&P 500 index. This long term out-performance is one good indicator of the quality of the underlying stocks in the index and their long term proven track records.

Current dividend aristocrats (from the February 2017 S&P factsheet):

Looking at the current constituents of the index is like looking at a who's who of American business. At the time of writing, it contains 51 companies and some of the largest names include Clorox Co, Abbot Laboratories, Johnson and Johnson, and Kimberly-Clark. The largest sector represented is the consumer staples sector which comprises 26% of the index. All companies in the index must have a market capitalisation of at least $3 billion.

Why issuing increasing dividends is so impressive?

When you invest in a company that has increased its dividend year on year, you are buying a class act. Raising dividends over a period of at least 25 years is a sign that the company has great products, sound management and knows how to invest in its own future earnings.

Companies are bound to have gone through good times and bad in a 25 year period. It means they have managed to come through difficult times (recessions) in the general economy and slowdowns in the markets in which they operate, as well as internal challenges.

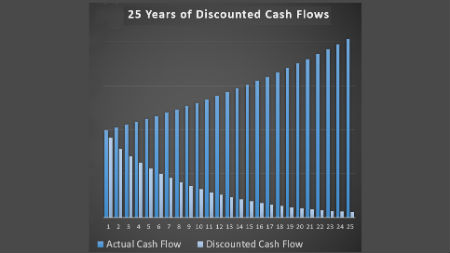

To be a dividend aristocrat, the company needs to have been consistently generating the cash to pay those ever rising dividends.

Raising your dividend for at least 25 years means that capital management has been strong from the respective managements and likely indicates underlying strength and durable competitive advantages in the businesses.

Of course, past performance does not guarantee future great performance but the management teams of these companies are under enormous pressure to keep up this consistent performance.

How can you possibly trump these stocks?

Well, the next step up is to the so-called "dividend kings". These are companies that have paid increasing dividends for 50 or more consecutive years.

You've seen how excited we get about firms that pay consistently increasing dividends so, as you can imagine, we can hardly contain ourselves when considering dividend kings. Currently there are 19 dividend kings that include names such as Johnson and Johnson, Genuine Parts Company and Coca-Cola.

Related links:

S & P 500 Dividend Aristocrats Index page

* Many companies in the S&P 500 decide to buy back shares rather than raising dividends. This is another method of raising return to investors because with fewer shares outstanding from one year to the next the stock price per share is likely to rise. Technically a company does not need to raise the amount of cash paid to shareholders to raise the per share payout. The dividend aristocrat index takes into account the payout per share not the overall pay out of the company.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.