Compound interest investing - How the best stock investments compound in 3 different ways

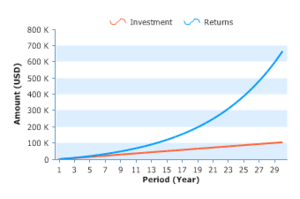

Compound interest investing is the path to prosperity. Most people know the basics about compound interest: how, given enough time and high rates of return, it can turn a nominal sum such as $1,000 into a seven figure fortune. But not too many people are aware that good companies are the best investments out there because they compound in several different ways.

If you were to park cash in a savings account or buy a bond then you'll receive an interest (or coupon) payment. You can then get compound interest to work for you by re-investing that payment into more bonds or a larger savings balance. You'll then be earning interest on the interest as well as on the original principal. Over time, this compounding will mushroom and be very powerful.

The good news is that compound interest investing with high quality stocks returns more value than this. How? Well it is because there are further ways for the investment to compound. Let's explore:

Benefits of compound interest investing #1:

Dividends reinvested

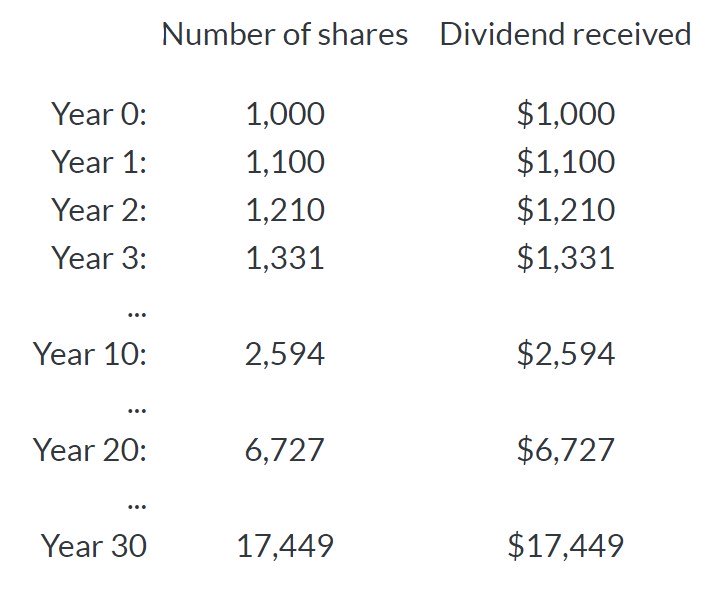

This is really similar to the savings/bond investment above. Assuming you've picked a stock that pays a dividend and things are going well for the business, you can re-invest that dividend into more shares each time you're paid. (Some companies offer a dividend re-investment program or DRIP which does this each month automatically).

As you come to own more shares, your future payments get higher and higher despite you not adding any extra of your own money.

Here's an example of this kind of compound interest investing: Imagine you invest $10,000 in ABC PLC at $10 per share. ABC PLC doesn't need to retain any capital so pays out all its profits to you as a shareholder. When you bought the shares, they pay out a 10% dividend, so you're earning $1 per share and paying that to you every year as a dividend. The earnings do not change and nor does the share price (not very realistic we know!), but let's see how your investment compounds over 30 years.

Benefits of compound interest investing #2

Retained earnings

Most companies do not pay out all their earnings as in the example above. Instead they retain some of their earnings to invest into the business and grow future earnings. Clearly the drawback here is that you don't have control over how those earnings are invested but the good news is that it saves you paying taxes on the dividends plus management may be able to invest the retained earnings at a higher rate of return.

What matters here is that the retained earnings result in earnings per share growth. Over time, this will lead to a higher share price if the earnings multiple stays the same. This means that in addition to the dividends you've re-invested, you can get growth in the share price which is roughly equal to the growth in earnings per share. The result - if all goes well - is an increase in the value of your investment and an increase in your dividend income. Neither of these exist if you own most fixed income bonds or with cash savings accounts.

Benefits of compound interest investing #3

Price rises

The very best companies are able to raise prices at least in line with inflation and not lose customers or sales. This is particularly important during an inflationary period where the cost of sourcing goods or providing services goes up. If a company cannot pass on these cost rises then profit margins will deteriorate which will have an adverse effect on earnings.

If, however, a strong company can raise their prices without pain then these companies can at least maintain their margins and will result in higher earnings as sales go up. Taking a company like Coca-Cola as an example, it is unlikely that someone changes their order in a restaurant because the price has gone up by a nickel.

Over time, these gradual price rises with retained margins will result in higher earnings by itself. This will be your third source of compounding in a great company and, once again, you won't receive this in a cash savings account or bond.

Bonus benefit of compound interest investing

A change in capital structure

If you buy into a company with a very safe capital structure (for example very little debt and/or lots of cash), you may benefit if the company decides to work the balance sheet harder. This could be through the excess cash being returned to you by a special dividend or share buyback, or it could be due to the company making an acquisition. This is not a sustainable source of compounding as it will not happen year after year but it should get extra capital to work for you quickly which,

in turn and if used properly, will start compounding for you quickly. This may or may not play out but when it does, it is a nice surprise.

Benefits of compound interest investing

Conclusion

There are enormous long-term benefits to compound interest investing and it is a good guiding principle for all investors looking to retire on dividends. That said, there are very few companies which tick all these boxes and those that do are the blue chip companies which usually sell on the market for very high multiples (i.e. with very low percentage dividends). That said, if you are a serious investor then you should be aware of the companies that can compound in different ways as, if you can buy them at attractive prices, these investments should result in terrific returns for you over time.

Other asset classes like cash and bonds do not compound like this. While property can to achieve both capital growth and rents rises roughly in line with wage increases, as an owner, you will have to set aside part of your rental income to invest into your property just to keep it in good, marketable condition, it is usually not that easy to invest in a way that allows you to radically increase the rental income, in the way that companies can multiply their earnings, if well managed.

Bottom line, if you find investments that can compound in several different ways, then hold onto them for dear life!

For companies which have been great examples of compound interest investing, take a look at our case studies:

Coca-cola 1988-2016

Johnson & Johnson 1982-2016

Walt Disney 1996-2016

Unilever 1966-2016

For a technical definition of compound interest, click here for Investopedia's glossary entry.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.