Dollar Cost Averaging - wise or unwise?

Dollar cost averaging is the process of continuously and steadily purchasing stocks (or other securities) so you "average" out your purchase prices.

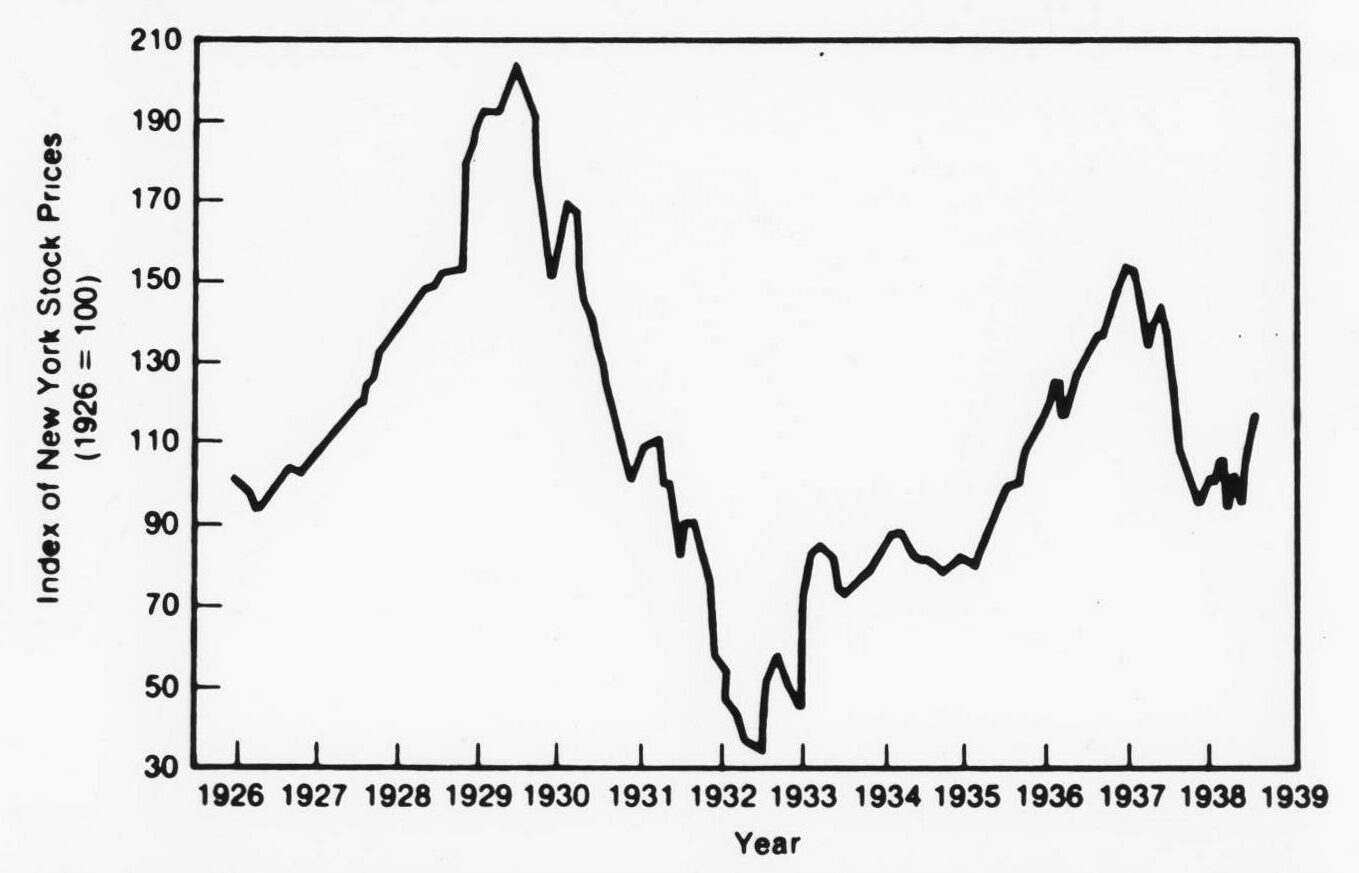

The idea behind it is to avoid the risk of the market dropping very suddenly just after you've made a very large purchase. Just imagine if you'd put your life savings, or invested your pension into the market the week before the 1929 stock market crash, whose graph is shown here...

The risk of such a big fall is ever present in the markets and can be very discomforting. Dollar cost averaging is a way for us all to feel more comfortable about our purchases.

Dollar cost averaging (or spreading your purchases) can be used either for a large lump sum or for continuous saving.

For continuous saving, you really don't have a choice. You can't get paid next year's wages in one go now so you have to just invest the cash as you receive it or when you find attractive opportunities. That said, if you receive a very large cash lump sum in one go such as an inheritance, redundancy package, bonus, or pension payment, you need to decide if you're better off investing it all at once or spreading your purchases over several months (or years) to try to smooth out the volatility of the market. Let's consider whether you should dollar cost average or not.

Benefits to dollar cost averaging

1) Lump sum investing could have a huge downside

Investing in equities is extremely risky in the short run. The fact is that the stock market has always been and will always be volatile. It can move up and down quite aggressively at times and in very unpredictable ways. It is perfectly possible that the market drops considerably immediately after you've invested a lump sum and this could challenge your temperament. Dollar cost averaging can therefore help you with market timing.

2) Dollar cost averaging can help you not to get fixated on your purchase price

Too many investors get obsessed by the price they paid for a stock or financial security. The fact is that the stock has no idea what you paid for it and it doesn't care. As an investor, you need to focus on the underlying asset you've purchased and what the asset is producing for you. What you paid to purchase the asset cannot be changed and it's a waste of time to worry about this. Dollar cost averaging can help you with this because spreading the purchases out means you shouldn't be so fixated on any one price you paid.

3) Dollar cost averaging over time can help you get into a savings habit

This, of course, doesn't apply if you receive a lump sum but if you are earning and building wealth month by month, then you should be able to dollar cost average over time by adding to your savings and reinvesting dividends and other investing proceeds. If you want to build wealth then it's crucial that you develop the savings habit and there is no better way to do that than to direct a portion of your earnings to an investment account as soon you get paid and from there to purchase investments.

Drawbacks to dollar cost averaging

1) Market timing is tough / impossible to do

Trying to time the market is a fool's game. The fact is that the stock market has historically spent most of the time going up. As Jeremy Siegel shows in Stocks For The Long Run, over a one-year period stocks have outperformed bonds and bills in the US around 60% of the time and, over twenty- year periods, stocks have always outperformed. If you hold back investing in the market then there is a strong chance that you'll have to pay higher prices in the future.

2) Investing as a lump sum has historically outperformed dollar cost averaging

Despite the risks associated with it, lump sum investing has in fact proven itself to be a more profitable strategy in the markets.

As we've mentioned the market is more likely to go up than down. Obviously this means that you're more likely to have cheaper prices today than in the future. This becomes even more of an issue once you factor in dividend payments and future income. Vanguard have done an extensive study that shows how lump sum investing - if you have the stomach for it - has historically outperformed dollar cost averaging in the US, UK, and Australia. You can find the paper here. It's well worth a read.

3) You can reduce costs

Making fewer purchases means you are likely to save on transaction costs. Remember that investment costs are one of the things you can control and can make a big difference to your long term results.

4) You can start earning dividends straight away

This is particularly important with interest rates being so low. Dividends in many markets are currently higher than the interest rates paid to savers. If you wait to invest your cash then you'll be earning less in interest than you could be in dividends by making the purchase immediately.

Conclusion

The facts show that you are more likely to be better off by investing a lump sum straight away but, as is so often the case with investing, the correct answer to the question of whether to invest a lump sum in a single chunk or to dollar cost average over a period of months or years is likely determined by your personal situation.

You need to make sure that any money you put into stock market investments is very long-term money and you have enough cash set aside to deal with unexpected cash calls. You also need to be aware that the market can drop if you invest straight away and if this is going to keep you up at night then maybe dollar cost averaging is best for you. For anyone with a strong temperament and the ability to focus on the underlying asset rather than the fluctuation in stock prices then you are more likely to be better off investing the lump sum immediately.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.