Saving to invest in your future dividend income? Seems slow, right?

WELL, READ THIS AND GET EXCITED!

If you're saving to invest or have already got money in income-producing assets, it takes patience and the enormous power of compound interest to change a modest sum into a serious one. If being patient isn't your strength, I hope this page will leave you excited and give you the staying power you'll need to keep saving and investing consistently in order to let the compounding miracle happen.

If you have any kind of consumer debt, then you're either going to have your dividend investment plans slowed or stopped altogether because it seems like you have to pay off debts first, and with a mortgage, those debts seem like they could take forever.

If your goal is to be saving to invest on a consistent basis, it's obvious you don't want payments on debts dragging down your efforts. Seeing the effect small changes in lifestyle can have on our debt and investment future is a powerful tool to get ourselves to take the right steps.

Here's an AMAZING example...

Saving to invest Step 1: Pay off debts

How far could you get towards your goals if you stopped buying a cappuccino and a sandwich on a daily basis?

Surely that's too small a saving to make a major difference?

In fact, no. This small lifestyle change can pay off debts and put you on a saving-to-invest track very quickly... Let's take a look:

Firstly the assumptions:

For the purposes of this article, I'm going to work through how quickly you can pay off debts and then invest if you replaced lunch and a coffee at Starbucks with a packed lunch and a home-made Nespresso (nobody should be forced to give up good coffee entirely!)

Here's what you can save:

The cost of Starbucks Caffe Latte Grande: $3.65 [Source: Menuwithprice.com]

The cost of a Starbucks Chicken BLT Salad Deli Sandwich: $5.95 [Source: Menuwithprice.com]

It doesn't matter what you save on... going out for fewer restaurant meals, giving up your cable TV subscription etc. etc. - you decide what you can best save on depending on your circumstances, but the sandwich and coffee example is a fun one!

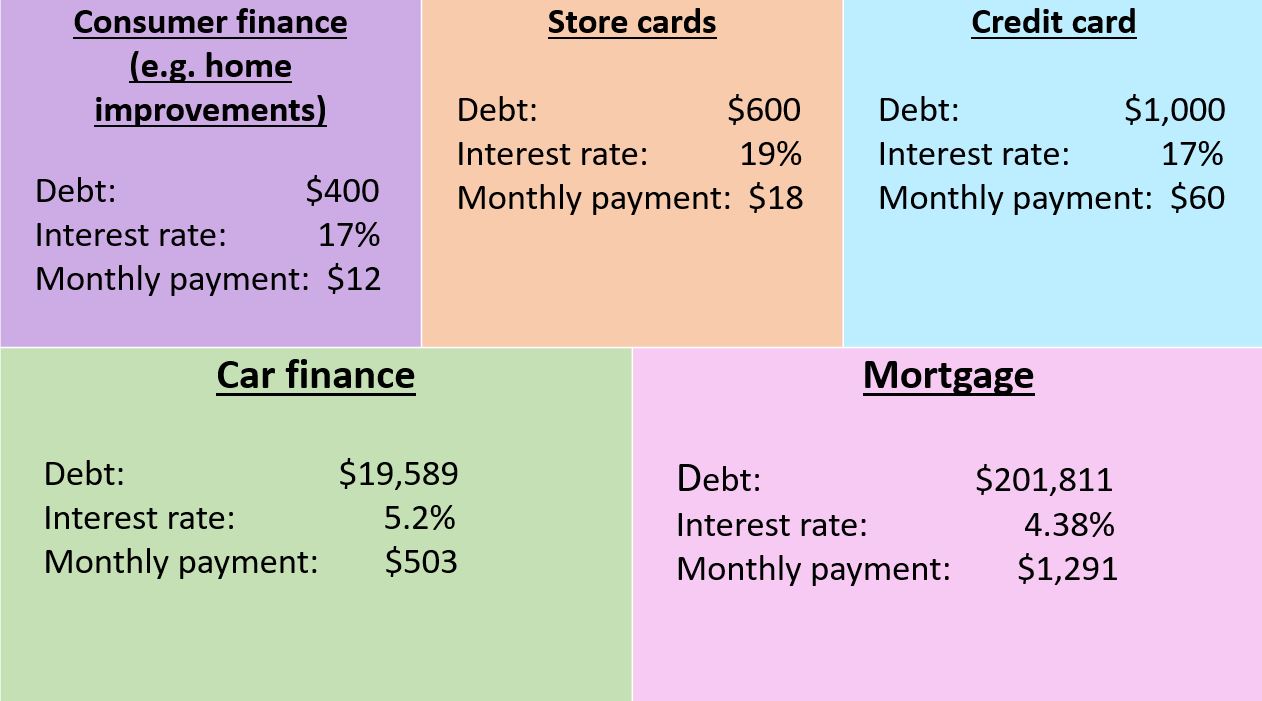

... and here are the debts of the "average" American:

Average outstanding mortgage: $201,811 [Source: Experian]

Average US 30-year mortgage rate: 4.38% [Source: Valuepenguin.com]

Average resulting monthly mortgage payment: $1,291

Average car loan amount: $19,589

Average monthly car loan payment: $503 [Source: CNBC]

The average interest rate on a car loan: 5.2% [Source: CNBC]

Average revolving consumer debt: $2,000 (credit cards: $1,000, store cards: $600; other loans e.g. furniture / tech financing: $400) [Source: I confess, this is an educated guess on my part - it's amazingly difficult to work out an average of residual debt on credit cards because disentangling residual or rolling debt from what is paid off every month is impossible]

Average interest payments on those debts: $60 credit card: $30 (at minimum payment level & 17% APR); store cards: $18 (at minimum payment level & 19% APR), other loans: $12 (at minimum payment level & 12% APR) [Source Creditcards.com]

Let's present this in the following image:

Assuming you're currently able to just keep up with the minimum payments on each of those loans and you're currently buying a sandwich and a coffee each day, you're actually in a very powerful position, even though you might not think so.

First of all let's work out... Just how much you could be saving to invest by avoiding the coffee shop each day?

If I buy one Chicken BLT salad deli sandwich and one Latte Grande each day of the week for 48 weeks of the year... that comes to a total of $9.60 x 5 x 48 = $2,304 per year in sandwiches and coffees (using prices from the Starbucks branch I most often visit in Anapolis, Maryland click here for their menu).

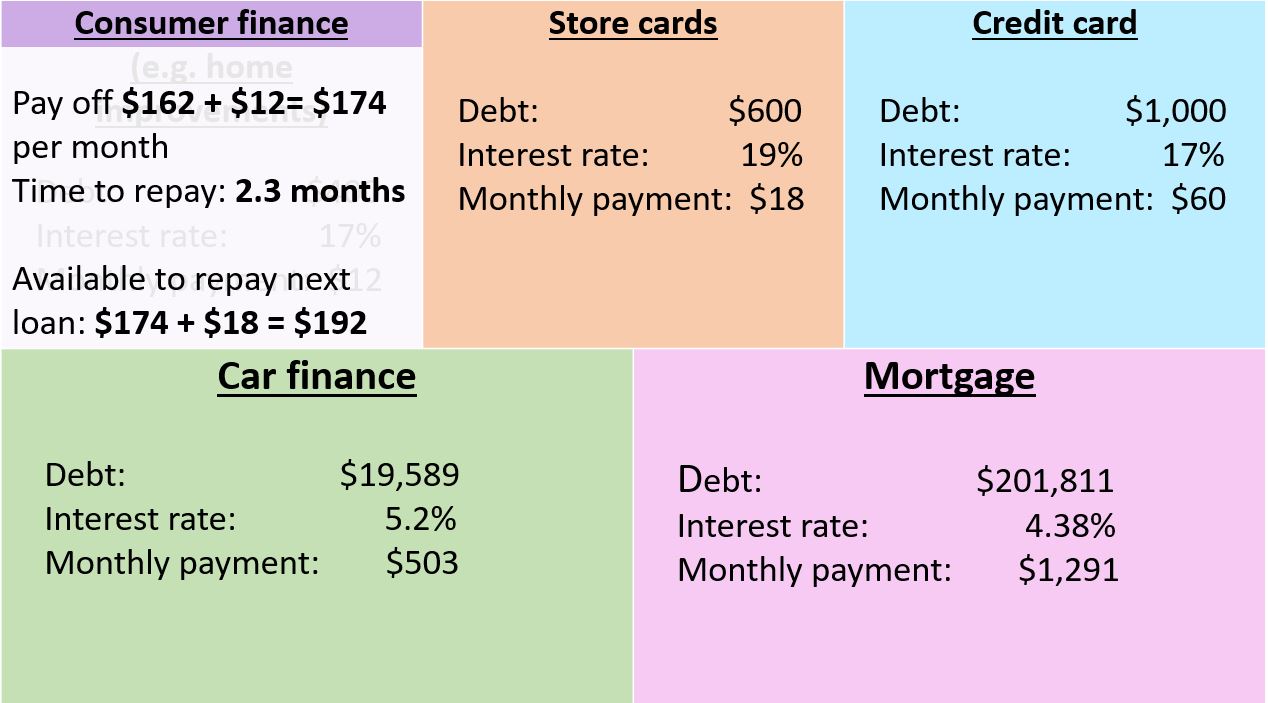

Assuming you can make your sandwich and a Nespresso for $1.50 per day at home, you could save yourself $8.10 per working day, $162 per month or $1,944 per year.

Which debt would you pay off first with your spare cash?

With debt, we're dealing with both economics and emotion. You'd think it'd be best to pay off the debt with the highest interest rate and economically speaking that would be most sensible, but I would argue that taking care of the emotions surrounding debt is more important. For that reason, I suggest you pay off the smallest debts quickly in order to have the feeling of gaining momentum.

By putting the $162 you've saved every month into that one small debt, very soon you'll cancel it completely and then can roll both the coffee-shop saving plus the minimum payment you were making on together to pay off the next smallest debt.

Here's how that looks:

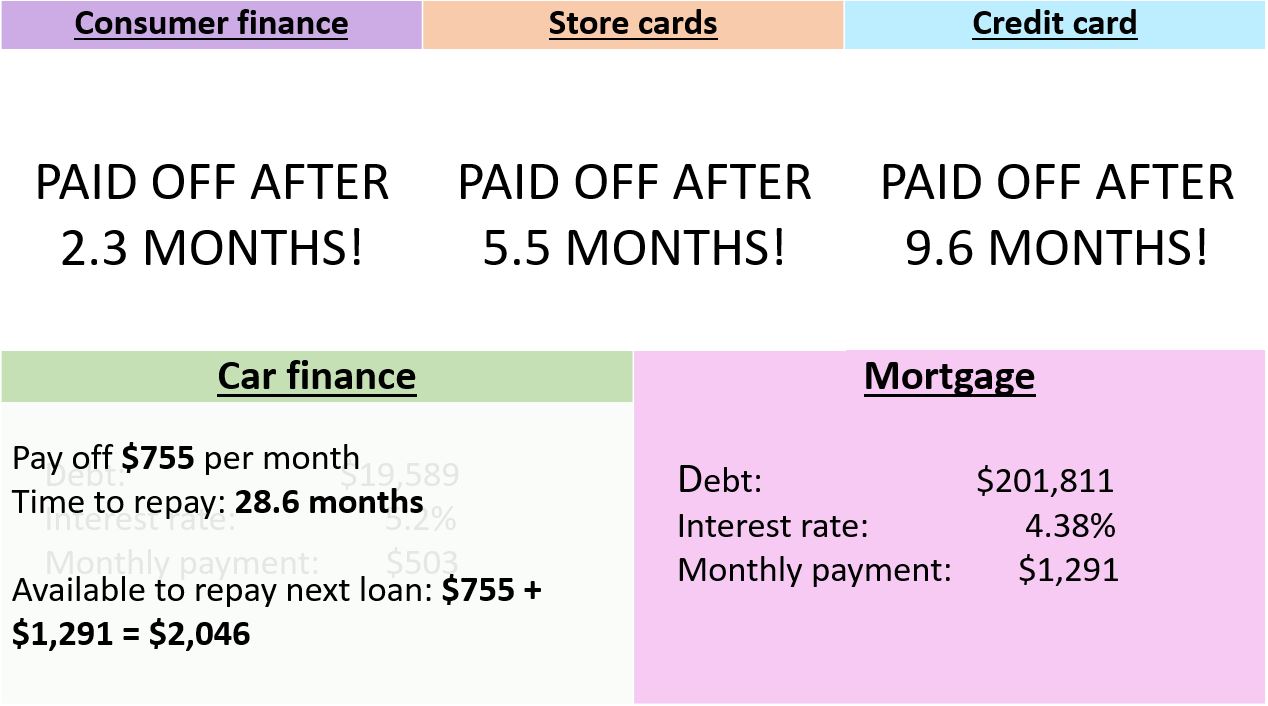

Step 1: Pay off small debt with "cappuccino money" and the minimum payment you were already making on that loan ($162 + $12 = $174). You'll clear the debt in a matter of months:

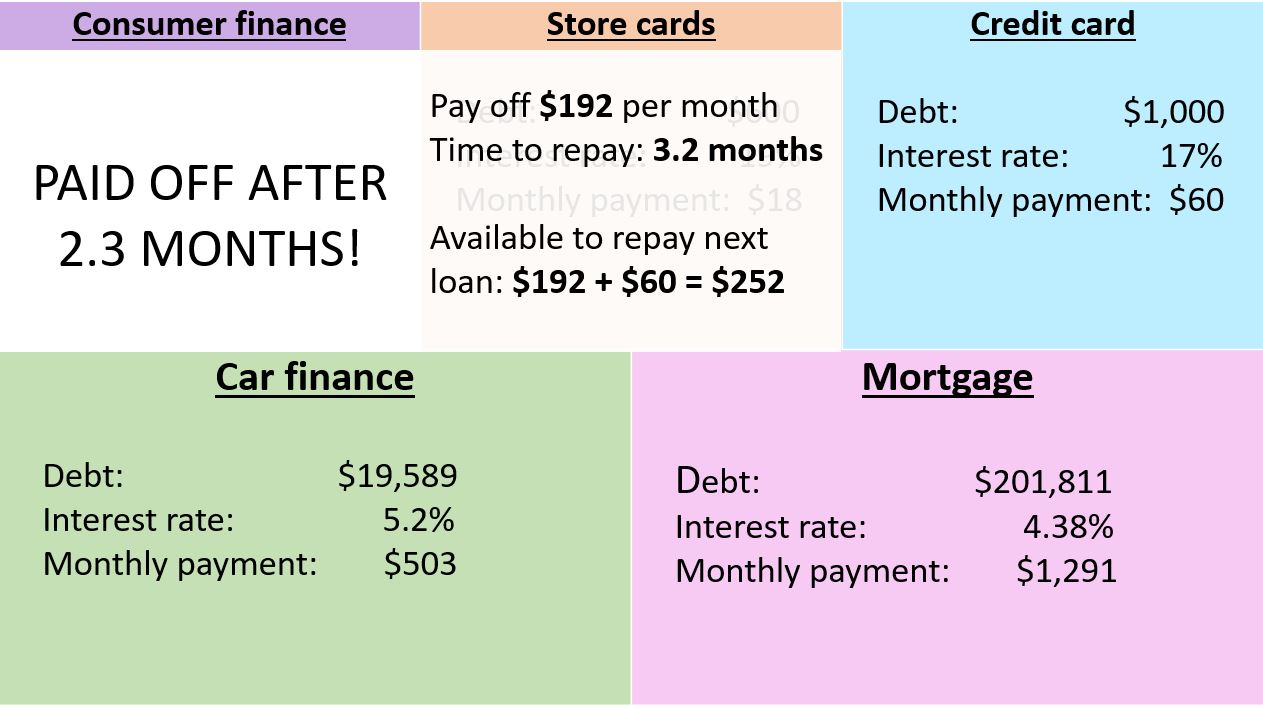

Step 2: Now you're using the $162 of "cappcuccino money" together with the minimum payment from the consumer loans (now paid off) and the $18 minimum payment from the store card loans to pay off the store cards ($162 + $12 + $18 = $192):

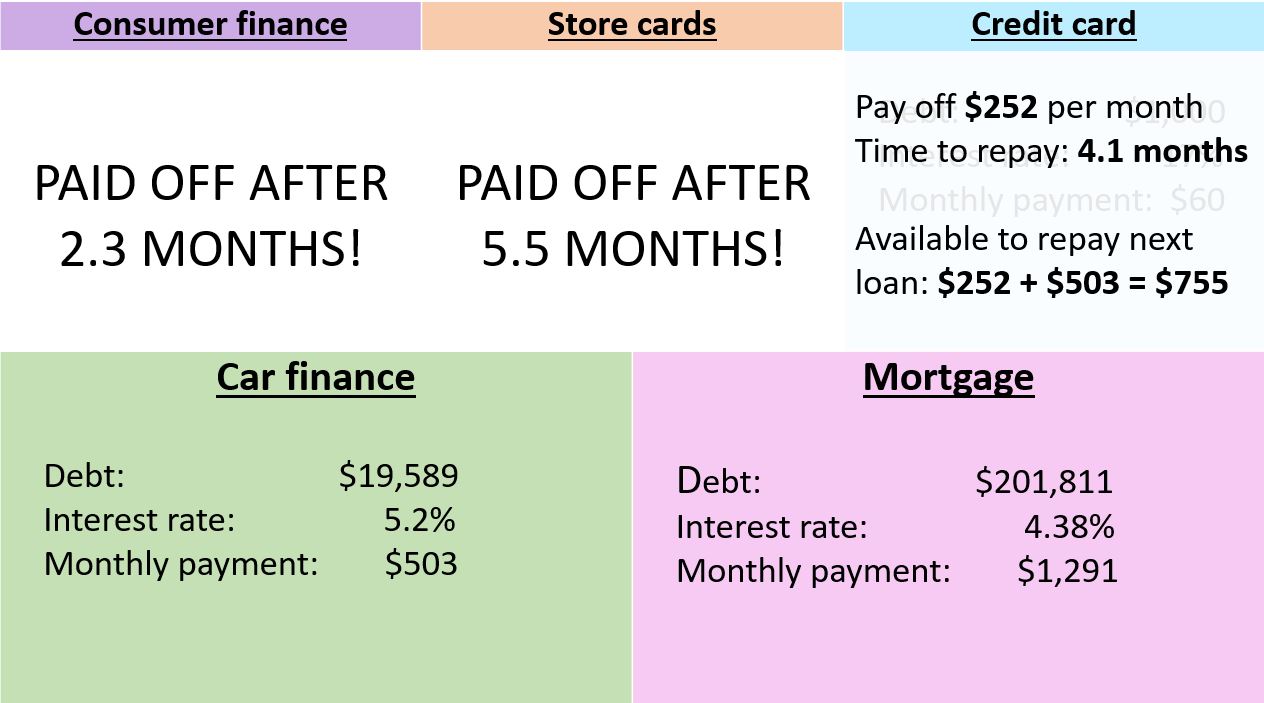

Step 3: Now it's getting serious - you've freed yourself from two debts and have $252 per month to aim directly at the credit cards ($162 + $12 + $18 + $60). Here's what happens:

I'm sure you get the hang of this now, rolling the "saving to invest" cash from not buying a cappuccino and a sandwich, plus the savings made by not having to make minimum payments on other loans means that you can pay increasing amounts off each loan.

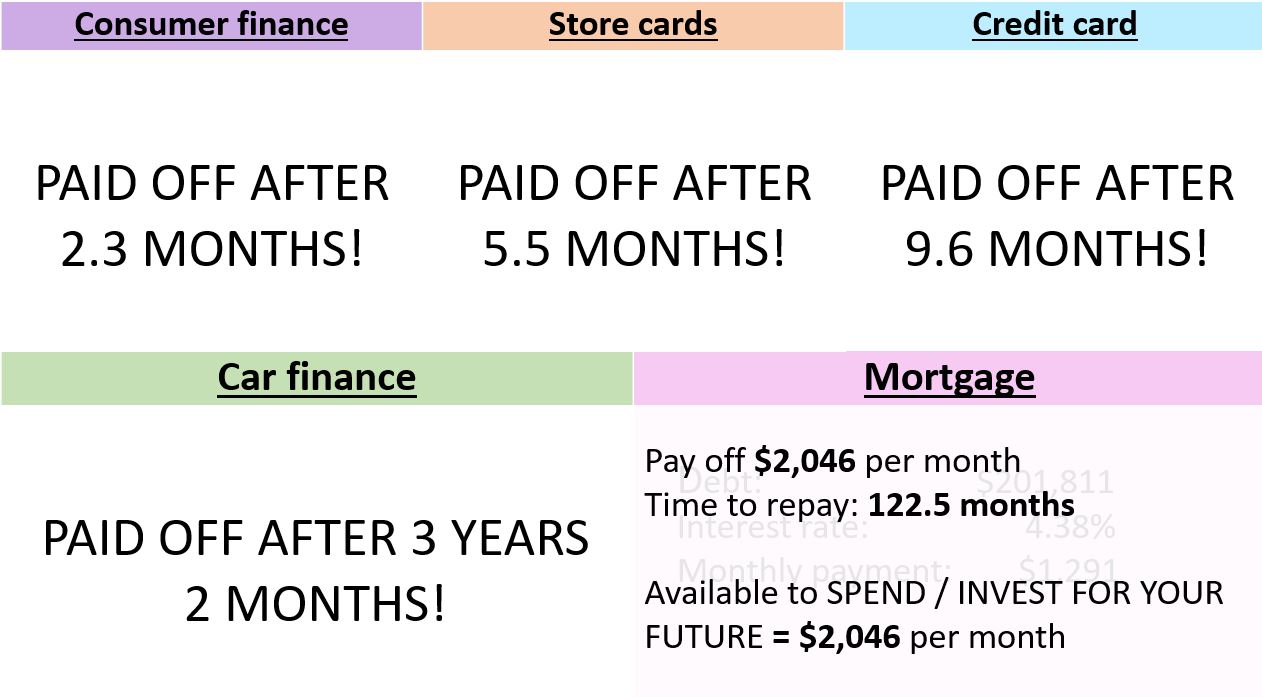

Look how this plays out:

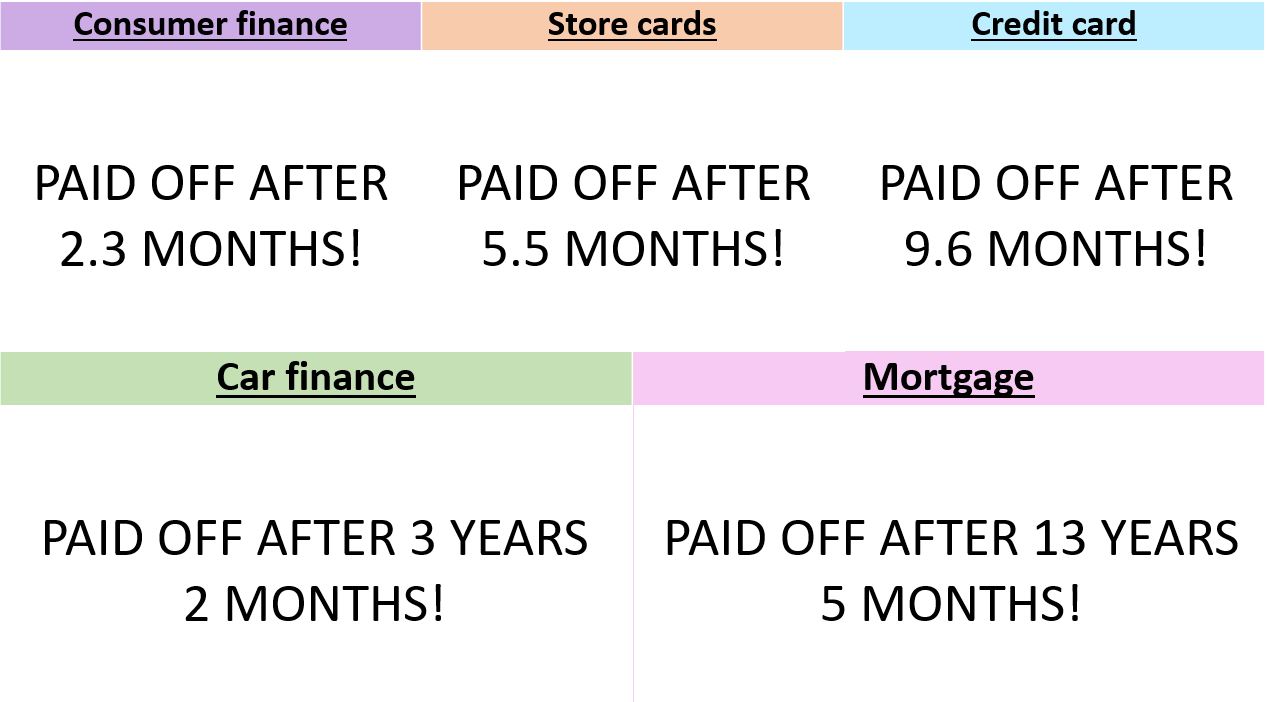

All the consumer debt and the car is paid off in just over 3 years and here's the kicker... Look how fast your biggest loans can be paid off now:

So from having no money left at the end of the month, but buying your sandwich and coffee every day, you've managed to pay off all debts including your 30-year fixed term mortgage (assuming the loan allows for overpayment) in less that 13 years.

Wow!

This is another kind of compounding which works in your favour.

Saving to invest step 2 - regular investment

Now you're entirely debt free, look what happens when you're consistently saving to invest the cash you're now not paying in debt and mortgage interest into the stock market at the average historical total return (i.e. with all dividends re-invested) of 9.69% per year [Source: The Motley Fool] using a Vanguard style ETF with tiny 0.05% annual fees.

You have $1,884 to invest per month and this is what that would be worth after 5, 10, 15, 20 and 25 years.

5 years $290,667

10 years $781,430

15 years $1,592,363

20 years $2,914,025

25 years $5,048,686

Not at all bad for simply giving up your coffee and chicken BLT and making your own food or taking left overs into work.

Of course, this won't match your situation perfectly - you may already be saving to invest on a monthly basis, or you may have higher debts. No matter where you are, it's always worth asking "could I cut my costs so that I could be saving to invest more in my future?"

It could be by lowering your energy bills or by commuting more economically. The beginning of a new year is a great time to do this, but frankly any day will do, so don't waste time, take a look at your monthly outgoings today!

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.