Should I invest in stocks?

"Should I invest in stocks?" isn't a straightforward question to answer. Stock investing is by no means for everyone.

But, if you can answer "Yes" to these 4 key questions, it could be the most powerful form of investing available to you.

Should I invest in stocks?

QUESTION #1 - Can you can think long term?

There's no getting round the fact that stocks are highly volatile in the short run, far more so than bonds or real estate.

If you spend every five minutes checking the value of your portfolio the stock market will drive you crazy. If you are going to invest for the long term then you need to be prepared to see some severe recessions. The US alone saw 20 recessions (including the depression) in the 20th Century. That's a lot of negative headlines!

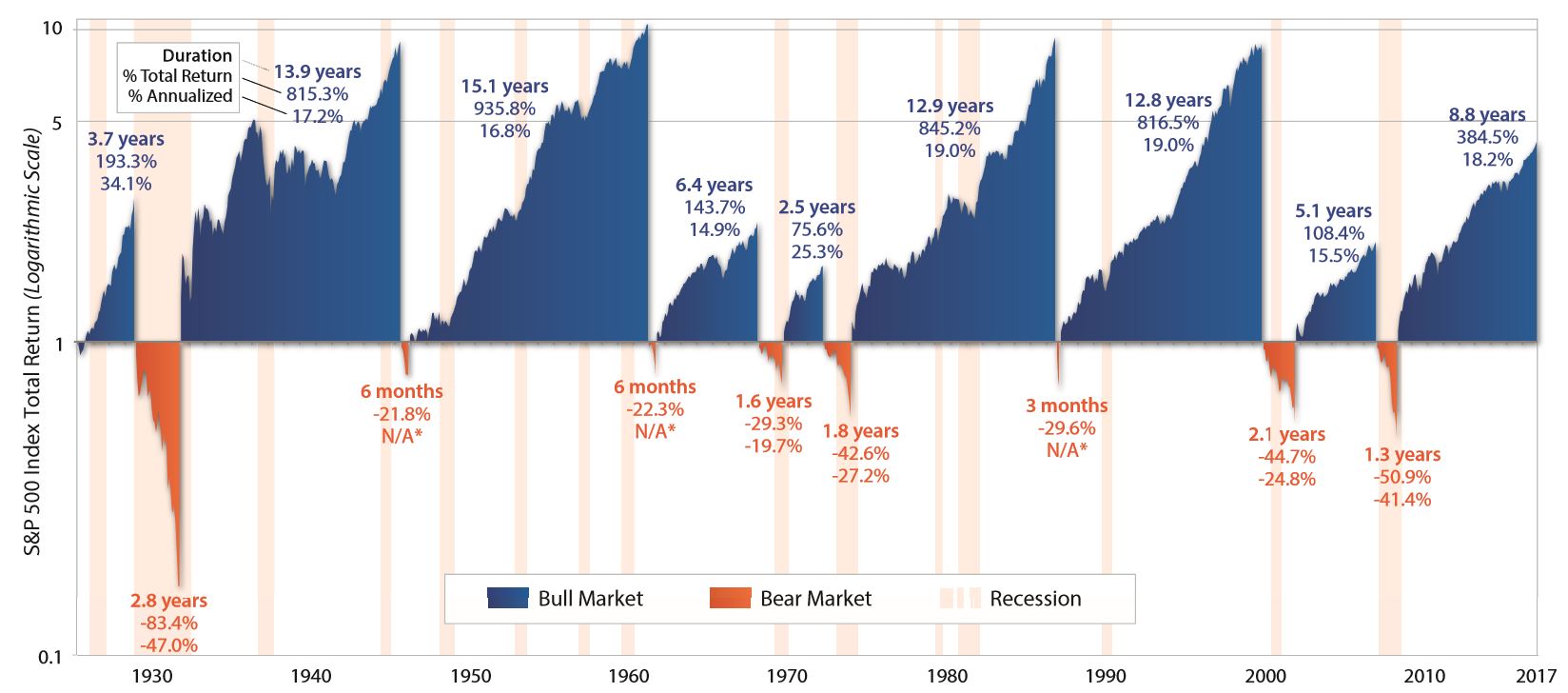

The S&P has fallen by at least 20% eight times since 1926, so on that schedule, if you are going to be investing for 40 years then you can expect three to four of these 20%+ drops in your investing lifetime. It will be "scary" every time and if you can't handle it then investing in the stock market is probably not for you.

Have a look at this chart for a history of bull and bear markets in the US since 1926.

(Click here to see the chart in full). Consider how you'd feel if the 20%+ drop happened the day after you invested your life's savings then you'll probably have an answer to the question: "Should I invest in stocks?" right there and then.

The good news is that, in the long term, stocks become far less risky. You're far more likely to do well if you keep holding and adding to stocks through thick and thin. As Jeremy Siegel says in his book Stocks For The Long Run, "Stock returns are much more stable in the long run than in the short run. Over time stocks, in contrast to bonds, compensate investors for higher inflation. Therefore, as your investment horizon becomes longer, put a larger fraction of your assets in equities."

For a fun read about a terrible market timer who still did pretty well because he never sold, have a read of this page.

Should I invest in stocks?

QUESTION #2 - Can you do it without borrowing?

Borrowing money to buy stocks is not like borrowing money to buy a house.

"Why?" you may ask.

The value of a house can go down just like a stock can.

Well that's true BUT, generally, most brokers will make you borrow on margin to buy stocks. This means that if stock prices fall then you need to fund your account with more cash. If you can't come up with the cash then the broker will sell your shares to cover the shortfall. This is NOT what happens when you have a mortgage against a property.

In fact, borrowing on margin was a major cause of the stock market crash of 1929. Throughout the 1920s, many investors were sucked into the huge bull market. This was egged on by Wall Street where brokers were lending to their customers on margin like never before.

John Kenneth Galbraith states in his excellent book The Great Crash 1929 "Early in the 20s the volume of brokers' loans varied from a billion to a billion and a half dollars....Brokers' loans reached four billion on the first of June 1928, five billion on November 1st and by the end of the year they were well along to six billion. Never had there been anything like it before." As he says "People were swarming to buy stocks on margin."

When the stock market crashed in 1929, panic selling took off as brokers were desperate to sell their clients stock to cover the shortfall in margin. This resulted in a surge of sell orders - it was a very significant reason behind the crash of that year.

You never want to be in a position where you are forced to sell your stocks.

This is because you could be forced to sell when the market is very depressed and valuations are low - resulting in you missing out on the subsequent gains. If you have bought stocks with cash and you have enough savings on the side then you should never be put in this position.

"Do I have to borrow to invest?" is as fundamental a question as: "Should I invest in stocks?" and it has precisely the same answer.

Should I invest in stocks?

QUESTION #3 - Do you have a rock-solid job or a cash buffer?

This is linked to the two points above.

Firstly, you must invest for the long term (you should aim to lock your cash away for at least ten years) and you must never become a forced seller. Without a cash buffer or the kind of job where you can't get the sack, then you maybe forced to liquidate your holdings at a terrible time.

When thinking about your cash buffer then think about the worst that could happen. What if you lost your job? What if you had a large medical bill to pay?

You should assess the cash that would be coming in if you didn't work. What passive income do you have? Could you live off the dividends, rent, interest and any royalties you receive? For most people, the answer to this is "no".

In many ways, the larger your portfolio gets the smaller your cash buffer could be as you may be able to fund more of your life through dividends. Make sure the dividends are sustainable though.

We'd recommend when starting out that you have AT LEAST six months worth of expenses as a cash buffer. Until you've got to this hurdle, you shouldn't even think about investing in the stock market. Instead focus on building up those savings.

Should I invest in stocks?

QUESTION #4 - Do you understand something about business valuation and accounting

Accounting is simply the language of business. You don't need to be a qualified accountant to invest in the stock market but you do need to understand the income statement, the cashflow statement, and the balance sheet. You should also read the notes that go with these accounts carefully. The more of these statements you read the better. It will help you recognize strong businesses and could alert you to common investing mistakes.

Understanding valuation is also vital. Overpaying for your investments can result in a serious drag on performance - even if you buy a good business. Again, by looking at many businesses and building experience you can get a better understanding of valuation and when your odds of good returns are more favorable.

If you don't understand accounting or business valuation, doesn't mean you have to automatically answer the question: "Should I invest in stocks?" with a "No" you can always use index trackers (such as ETFs to track the S&P 500) or mutual funds. This will help give you exposure to the overall "market" without knowing the small details. Over time, you will do as well as the underlying businesses but you will still need a long term horizon, and cash on the side.

In Conclusion...

Should I invest in stocks? (Well should I, punk...?!)

YES, if you can stomach high volatility in the short run.

YES, if you've got plenty of patience and a strong temperament.

YES, if you consider it investing not speculating

YES, if you can focus on the underlying assets. What they earn and what you get (or expect) in dividends.

YES, if you can avoid getting wrapped up in the day to day movements of the market and focus on the asset itself.

If you CAN'T answer "yes" to any of these, then don't dabble in stocks.

But don't worry! If you decide the stock market is not for you that's not a problem. There are plenty of other ways of getting rich. You form your own business, earn from real estate, or earn from other passive sources. The important thing is you understand what you are doing. Otherwise you're doomed!

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.