"Survivorship Bias" - one massive advantage of ETFs

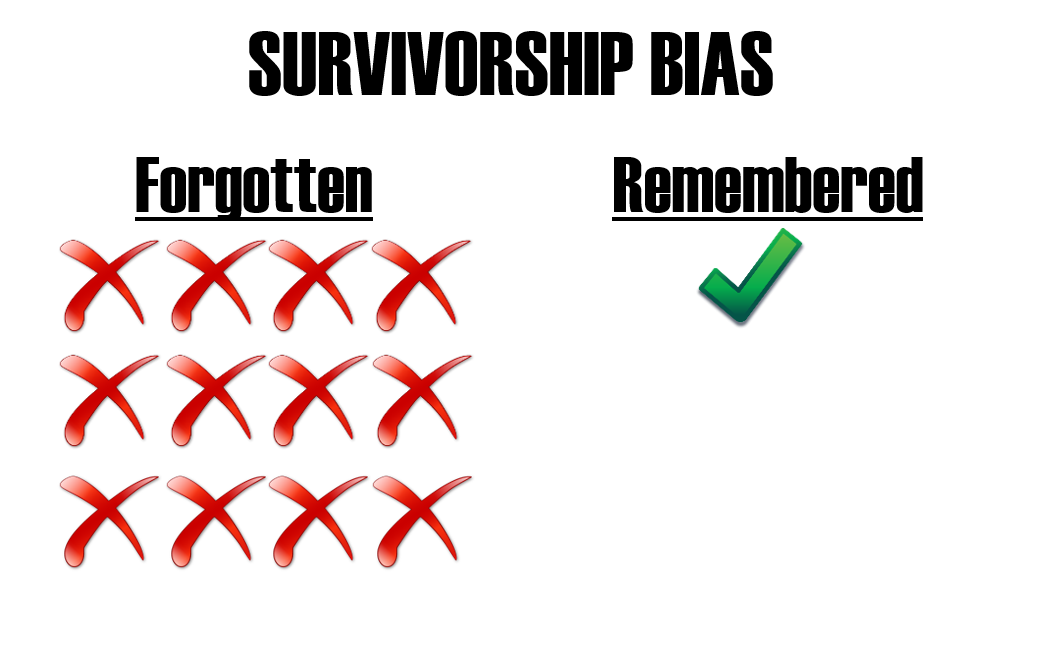

The phenomenon of "survivorship bias" is a clear benefit of investing in ETFs rather than individual stocks. It cuts the risk of losing all your cash in one or two companies that may go bust and keeps your cash following winners.

How? Well let's first consider what tracker ETF does with an example. Take a look at the following list of companies:

- American Cotton Oil

- American Sugar

- American Tobacco

- Chicago Gas

- Distilling & Cattle Feeding

- General Electric

- Laclede Gas

- National Lead

- North American

- Tennessee Coal and Iron

- US Leather

- US Rubber

I'm guessing that you probably only recognize one - General Electric. The others (with the exception of Laclede Gas) all disappeared some time ago. These twelve companies, though, are the original components of the Dow Jones Index (DJIA).

If Index funds had existed back in 1896 (when the DJIA started) then these would have been your holdings. Yet none of them are in the DJIA (GE was the last to be dropped in 2018) today so would your index holding be worthless? Of course not! In 1896 the DJIA was at 40.94 and today (2019) it hovers around 26,000. An investment of $1,000 in a DJIA index tracker in 1896 would now be worth around $634,000 and that doesn't even include dividends. This is despite you now holding NONE of the original companies. How does this happen?

That answer is SURVIVORSHIP bias. Simply put, if a company's market capitalization falls to where it is no longer in the index then your index tracker will sell those shares and replace it with whatever has come into the index. Not only that, but index trackers re-balance as well (typically every quarter), meaning that they will have holdings in each share as a proportion of that share's effect on the index.

It is probably best illustrated with a market capitalization index such as the S&P 500 (most indexes are weighted this way but the DJIA is not). If a company such as Microsoft makes up 4% of the S&P 500 then an S&P 500 tracker will allocate 4% of its assets to Microsoft shares. If, however, Microsoft hits hard times and the shares fall to just 2% of the index then the index fund will sell shares to "re-balance" so Microsoft is only 2% of its holding. This means that, over time, your investment in the fund should closely track the underlying index. Any differences in your performance compared to the underlying index is known as "tracking error" and the index providers do their best to minimize this.

ETFs and survivorship bias results in stress free investing!

The best thing about this is that you if you just continously invest in a low cost index tracker then you really don't need to think about what else you do! You will automatically start picking up shares in the next "winners" as they grow their market capitalizations and become more important. Who would have thought thirty years ago that your largest holdings might include Google (Alphabet), Apple, Facebook, Microsoft, etc (some of these didn't even exist!).

The benefit is we don't know what the future holds. If you own the S&P 500 tracker and the biggest companies in the world include some space tourism company or medical robotic company that has yet to exist then you'll be a holder! You will participate. If a great company of today shrinks and becomes more insignificant then you'll gradually have your exposure reduced to where you may not even hold it if it drops out of the S&P 500.

ETFs and survivorship bias means your holdings can't go to zero as long as the index exists!

Unlike individual stocks where you can get a sudden nasty surprise (fraud/accounting error, etc) which can suddenly deem your holding worthless overnight, an index tracker won't go to zero. Of course, the tracker could hold stocks that do go bust but in a diversified index this effect should be relatively minor. As long as the entire stock market is not destroyed (it has happened like Russia 1917 or China 1949) then the index will exist and there will be holdings for you meaning you don't need to worry about your holding suddenly going to zero.

Survivorship bias is very useful as it means you don't need to be an accounting expert or spend hours searching for great investments. In fact, Warren Buffett suggested in his 2013 letter to shareholders that his will states that his wife put 90% of his assets into a low cost tracker and the other 10% in cash to use if markets get depressed. We think this is excellent advice for the amateur investor and survivorship bias (along with rebalancing) means they will benefit with the overall economy.

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.