ISA or SIPP?

How a financial advisor saved me £115,000 in 45 minutes

ISA or SIPP? Which is the most effective vehicle available to UK-based investors planning their retirement? First of all some definitions:

|

ISA = individual savings account SIPP = self-invested pension plan |

Both allow you freedom over your investments and both offer tax benefits. In the choice between and ISA or SIPP, I always felt the ISA had it. No penalties or limits when you withdraw your cash and no capital gains tax or dividend tax. To me it seemed absolutely tax free. But I was wrong, and I discovered this only recently when I interviewed James Sumpter on the subject of retirement planning.

James Sumpter is a superstar financial advisor - a partner at Tilney Bestinvest. He doesn't name any of his clients, but they include some of the very top earners in London's financial sector, Premiership footballers and self-made millionaires a-plenty (and the great news is, for a limited time, he's offered to answer your questions on pensions or investment planning if you complete the form below)

In the ISA or SIPP debate James was quite clear: "I would even consider taking money out of an ISA and putting it into a pension just to get the tax relief."

"Tax relief ... What tax relief?" I thought.

That's where my PAYE / employee mindset was tricking me. If you're not based in the UK, PAYE might not be a familiar term - it means "Pay As You Earn" and boils down to the fact that your salary arrives in your bank account each month with all income tax and National Insurance, plus any employer-provided pension contributions deducted.

Your employer basically handles your tax declaration and you only need to do an additional tax declaration if you have outside or more complex earnings. The majority of employees - even up to the very highest managers - do not make a separate tax declaration.

So, given that I'm investing £650 per month of out my (taxed) income and I'm a higher rate (40%) tax payer, if I put that cash into a SIPP rather than an ISA, I'm able to claim back the tax I paid and invest that as well. My £650 (US $814) in this scenario becomes £1,083 ($1,361) per month.

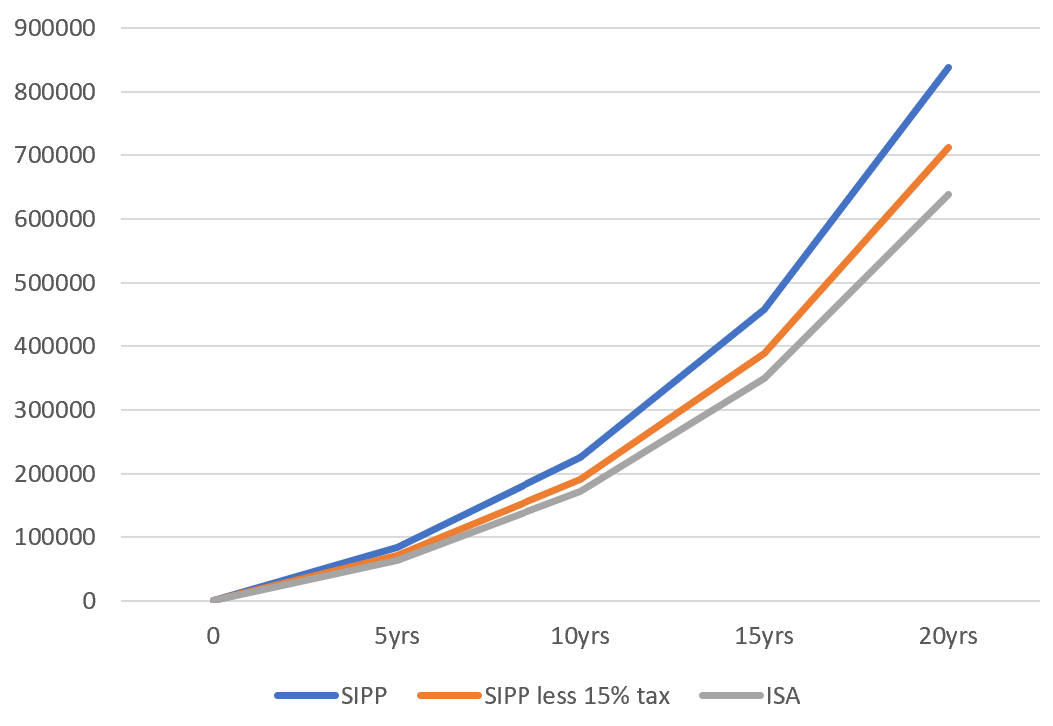

The restrictions that apply to an ISA or SIPP do vary and I will have to pay tax on the cash when it comes out of the pension pot, but that will almost certainly be at a far lower rate unless I somehow become a huge passive income earner in the meantime. James told me that most pensioners with "normal income" from a pension pay around 15% of their gross withdrawals in tax in the UK, so as the graph below shows, I'll have a considerable amount more in my pension pot on retirement (the blue line) and even after paying tax at around 15%, I'll be ahead of the ISA amount (the orange line compared with the grey line).

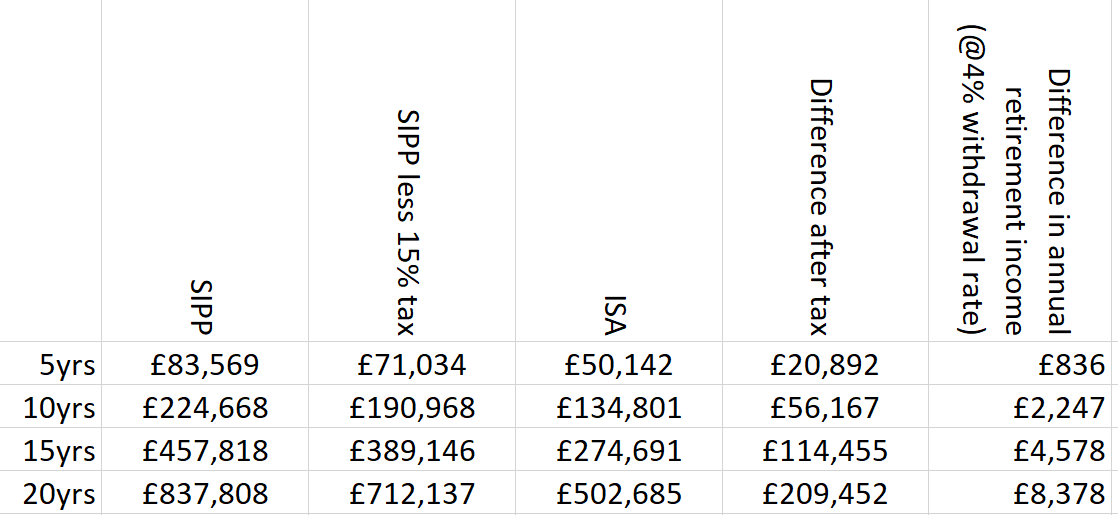

If you'd rather have it in figures, here you go:

As you can see, the difference in 15 years after accounting for tax would be £114,455 (US$145,357) and after 20 years would be £209,452 ($266,004), but even this is understating the advantage of this structure, because SIPPs allow you to take a tax-free lump sum on retirement.

ISA or SIPP? The tax-free lump sum

Another consideration in the ISA or SIPP decision is that you can currently take up to a 25% tax-free lump sum on retirement, although this can be no earlier than 10 years before the statutory pension age which means 57 years old. So that would make the SIPP yet more attractive.

The only downside to this change in my affairs is the fact that I'll be at the mercy of the UK government's decisions on when and how I can withdraw cash, plus the rate of taxation that I'll pay is an "unknown" that wouldn't affect me if I keep my cash in an ISA. I remember my Dad moaning about changes in government policy as they affected his pension, but if I keep at least a portion of my cash in the ISA, I'll probably have the flexibility to navigate any changes and still be better off.

So, I guess in a roundabout way, the answer to the ISA or SIPP conundrum is to use both, but favour the SIPP!

Have your pension questions answered FREE by Tilney Bestinvest partner James Sumpter and his team

Got a BURNING dividend question for 6-figure dividend earner Mike Roberts?

What is it that you really want to know about investing?

Submit a query and Mike will write a page in response.

PLEASE NOTE - in accordance with our terms of use, responses are meant for education / interest only. We do not give specific financial advice.